This article explores the financial challenges faced by single individuals, known as the singles tax. It offers practical solutions like smart sharing for expenses, co-buying property, and house-hacking strategies. The article also emphasizes the importance of maximizing pension contributions, investing wisely, and claiming available discounts and subsidies.

Many financial systems are based on people operating their finances as a couple, leaving single people to potentially foot a staggering bill. This is commonly known as the singles tax, but it isn’t unavoidable, as two experts laid out some steps to shield your wallet from the cost of living alone.

Kate Daly, co-founder of Amicable, encouraged people to consider “smart sharing” to help spread the burden of everyday costs. She explained: “Being single doesn’t mean you have to shoulder every expense alone. Trying to get a foothold on the property ladder as a singleton can seem impossible, but Kate recommended a similar “smart sharing” approach. She said: “Co-buying a property with a trusted friend, sibling, or family member can make homeownership more accessible, with joint ownership agreements ensuring both parties are protected.”

Losing a partner’s income can leave some people worrying for their financial future but Ali Poulton, Head Financial Coach at Octopus Money, highlighted the resounding financial freedom it brings to. She shared: “You just need to find ways to make your money work harder for you.

SINGLES TAX SMART SHARING FINANCIAL FREEDOM INVESTING SAVINGS

United Kingdom Latest News, United Kingdom Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

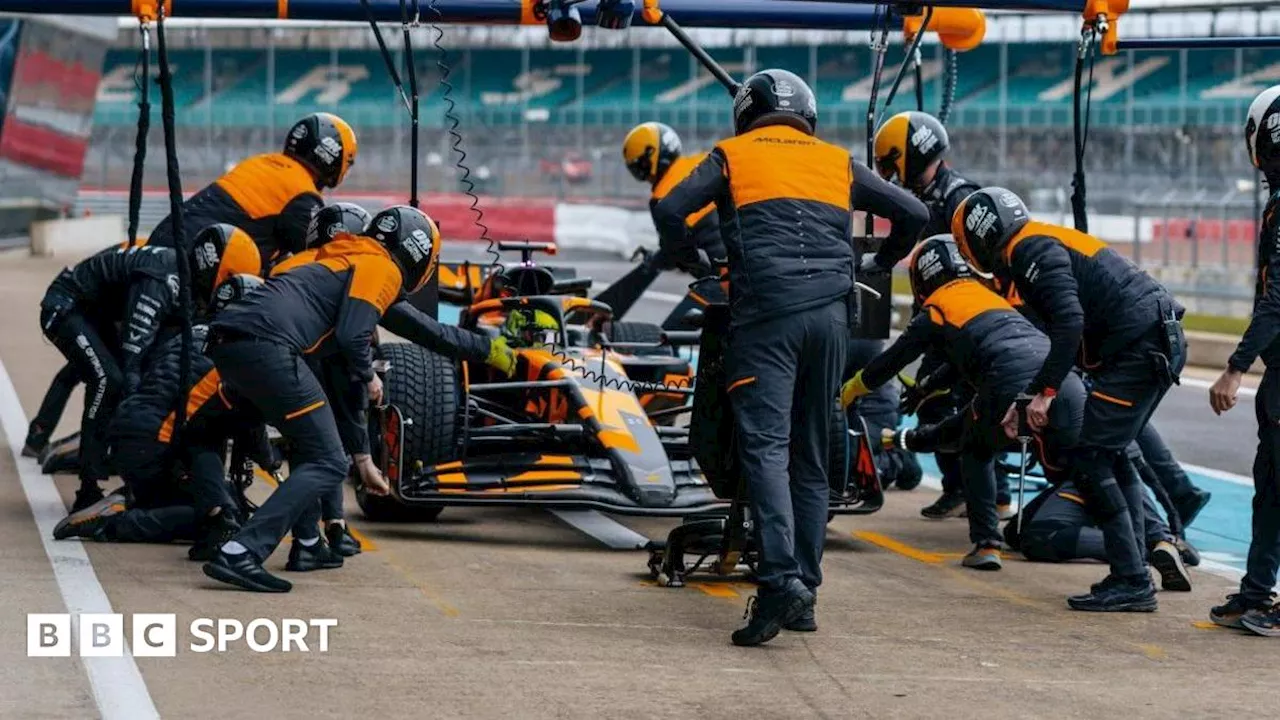

McLaren 2025 car: Lando Norris says he needs to be smart to beat Max VerstappenLando Norris says he needs to get his 'elbows out' but also be 'smart' in his battles with rival Max Verstappen on track this year.

McLaren 2025 car: Lando Norris says he needs to be smart to beat Max VerstappenLando Norris says he needs to get his 'elbows out' but also be 'smart' in his battles with rival Max Verstappen on track this year.

Read more »

BBC Licence Fee Reform: 'Netflix Tax', Wealth Tax and Subscription Models on the TableThe BBC is facing calls for reform of its licence fee funding model. Options being considered include asking wealthier viewers to pay more, a 'Netflix tax' on streaming platform subscribers, and voluntary subscriptions. Ministers aim to find a solution that 'future-proofs' the broadcaster without imposing a new 'TV tax' on struggling voters.

BBC Licence Fee Reform: 'Netflix Tax', Wealth Tax and Subscription Models on the TableThe BBC is facing calls for reform of its licence fee funding model. Options being considered include asking wealthier viewers to pay more, a 'Netflix tax' on streaming platform subscribers, and voluntary subscriptions. Ministers aim to find a solution that 'future-proofs' the broadcaster without imposing a new 'TV tax' on struggling voters.

Read more »

Tax-free Personal Allowance could mean you're about to pay more taxThe Personal Allowance is the amount of money you can earn before you start paying tax

Tax-free Personal Allowance could mean you're about to pay more taxThe Personal Allowance is the amount of money you can earn before you start paying tax

Read more »

Reform UK Plans Windfall Tax on Renewables and Inheritance Tax Ban for Solar Panel FarmersReform UK leader Nigel Farage and deputy leader Richard Tice announced their economic and renewable energy policy, including a windfall tax on renewable energy companies and a ban on farmers who install solar panels on their land from claiming inheritance tax relief. They argue that this will raise £10 billion, enough to cut energy bills by £350 a year, and prevent a conflict of interest between food production and the renewables industry. However, critics warn that the party's stance on climate change could alienate voters.

Reform UK Plans Windfall Tax on Renewables and Inheritance Tax Ban for Solar Panel FarmersReform UK leader Nigel Farage and deputy leader Richard Tice announced their economic and renewable energy policy, including a windfall tax on renewable energy companies and a ban on farmers who install solar panels on their land from claiming inheritance tax relief. They argue that this will raise £10 billion, enough to cut energy bills by £350 a year, and prevent a conflict of interest between food production and the renewables industry. However, critics warn that the party's stance on climate change could alienate voters.

Read more »

Delayed Tax Letters Could Leave Hundreds of Thousands Facing Unexpected Tax BillsHMRC delays P800 tax calculation letters by up to four months, leaving savers facing potential tax shocks in April.

Delayed Tax Letters Could Leave Hundreds of Thousands Facing Unexpected Tax BillsHMRC delays P800 tax calculation letters by up to four months, leaving savers facing potential tax shocks in April.

Read more »

Avoid £195 EV Tax Hike: Renew Your Vehicle Tax EarlyElectric vehicle (EV) owners can potentially avoid a £195 annual tax increase by renewing their vehicle tax before April 2025, according to a motoring expert. The change in VED rules comes into effect on April 1, 2025, when EVs will be subject to the same tax as petrol and diesel vehicles. By renewing their tax before the deadline, EV owners can delay the payment of the new rate for an extra year.

Avoid £195 EV Tax Hike: Renew Your Vehicle Tax EarlyElectric vehicle (EV) owners can potentially avoid a £195 annual tax increase by renewing their vehicle tax before April 2025, according to a motoring expert. The change in VED rules comes into effect on April 1, 2025, when EVs will be subject to the same tax as petrol and diesel vehicles. By renewing their tax before the deadline, EV owners can delay the payment of the new rate for an extra year.

Read more »