The UK government is considering changes to cash ISAs, prompting a debate between City of London firms advocating for their elimination and building societies defending their importance for savers. The article analyzes the different types of ISAs, their tax benefits, and the considerations for choosing between a cash ISA and a traditional savings account.

The UK government is reportedly considering changes to cash ISAs, a tax-advantaged savings product. These proposed changes have sparked debate, with City of London firms advocating for the elimination of the tax break for cash ISAs while building societies strongly oppose the idea. Building societies argue that any alteration to ISAs could have detrimental consequences for savers. ISAs, or individual savings accounts, allow individuals to deposit money and earn interest tax-free.

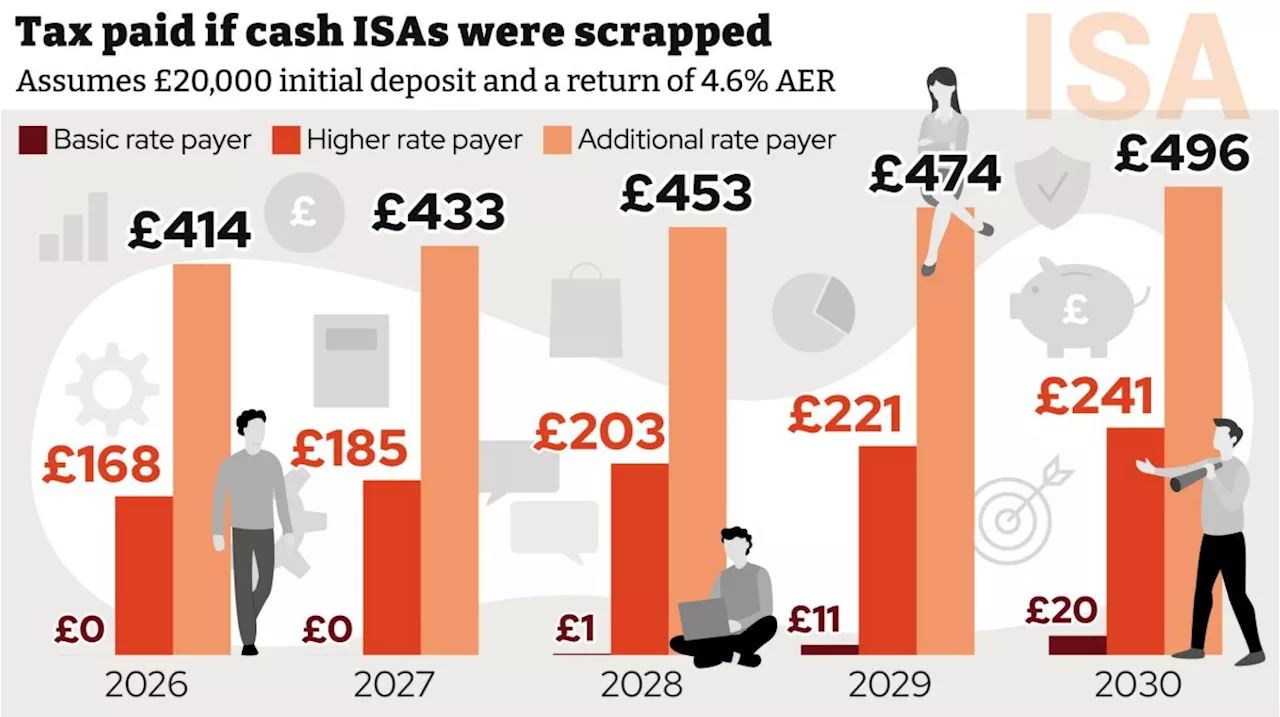

Currently, those with cash ISAs can contribute up to £20,000 per tax year. Different types of ISAs exist, including cash ISAs and stocks and shares ISAs. Cash ISAs offer guaranteed returns, making them a suitable option for emergency savings. Stocks and shares ISAs, on the other hand, provide the potential for higher returns over the long term, but with greater volatility.The Building Societies Association has urged Chancellor Rachel Reeves to reject calls for the abolition of cash ISAs. They emphasize the importance of preserving this tax-efficient savings product for individuals, particularly those who might face tax liabilities on their savings interest. A key consideration for individuals choosing between a cash ISA and a traditional savings account is the impact of tax. Basic-rate taxpayers with savings of £20,000 earning 5 percent or more may find themselves subject to tax. In such cases, a cash ISA can offer significant tax advantages. Consumer website MoneySavingExpert.com recommends a simple method for comparing cash ISAs and traditional savings accounts. Individuals should multiply the interest rate of the ISA by 1.25. The resulting figure represents the minimum interest rate required on a regular savings account to surpass the benefits of the ISA. If the regular savings account rate falls short of this benchmark, the cash ISA emerges as the more advantageous option.Currently, Trading 212 offers the most competitive easy-access ISA at 5.03 percent, exceeding the rates offered by non-ISA savings accounts. While Coventry Building Society provides a 4.85 percent rate on its easy-access savings account, it imposes a limit of four withdrawals per year

CASH ISA TAX BREAK SAVINGS UK GOVERNMENT BUILDING SOCIETIES INVESTMENTS INTEREST RATES

United Kingdom Latest News, United Kingdom Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Cash ISAs Under Threat: Should UK Savers Lose Tax-Free Savings?The future of Cash ISAs in the UK is uncertain as city firms push for their abolition, arguing that they encourage low returns and should be replaced by stocks and shares ISAs. Building societies strongly oppose this move, highlighting the crucial role Cash ISAs play for individuals saving for short-term goals and protecting them from higher taxes.

Cash ISAs Under Threat: Should UK Savers Lose Tax-Free Savings?The future of Cash ISAs in the UK is uncertain as city firms push for their abolition, arguing that they encourage low returns and should be replaced by stocks and shares ISAs. Building societies strongly oppose this move, highlighting the crucial role Cash ISAs play for individuals saving for short-term goals and protecting them from higher taxes.

Read more »

Cash ISAs: A Potential Target for Reform?Concerns have been raised about the future of Cash ISAs in the UK, with some financial institutions proposing their abolition. This move could lead to higher tax bills for millions of savers. The debate centers around the balance between encouraging long-term investment and providing a tax-efficient option for short-term savings.

Cash ISAs: A Potential Target for Reform?Concerns have been raised about the future of Cash ISAs in the UK, with some financial institutions proposing their abolition. This move could lead to higher tax bills for millions of savers. The debate centers around the balance between encouraging long-term investment and providing a tax-efficient option for short-term savings.

Read more »

Martin Lewis tells fan 'do the opposite' amid cash ISA raid fearsSpeculation is mounting that ISAs could be a target to raise revenue and finance guru wades in with his advice

Martin Lewis tells fan 'do the opposite' amid cash ISA raid fearsSpeculation is mounting that ISAs could be a target to raise revenue and finance guru wades in with his advice

Read more »

Cash Isa Tax Break Cuts Seen Triggering Mortgage CrisisThe UK Chancellor, Rachel Reeves, is facing warnings that reducing tax benefits on cash Isas could lead to a surge in mortgage rates and a housing market downturn. City firms argue that the nearly £300 billion held in cash Isas could generate better returns if invested in the stock market, but building societies warn that such a move would restrict lending and push up prices for homebuyers.

Cash Isa Tax Break Cuts Seen Triggering Mortgage CrisisThe UK Chancellor, Rachel Reeves, is facing warnings that reducing tax benefits on cash Isas could lead to a surge in mortgage rates and a housing market downturn. City firms argue that the nearly £300 billion held in cash Isas could generate better returns if invested in the stock market, but building societies warn that such a move would restrict lending and push up prices for homebuyers.

Read more »

Hands off our cash ISAs! Chancellor warned proposal to slash amount that can be put in tax-free...Major firms argue that almost £300 billion sitting in cash Isas would generate better returns - and help Labour's growth mission - if it was instead invested in the much riskier stock market .

Hands off our cash ISAs! Chancellor warned proposal to slash amount that can be put in tax-free...Major firms argue that almost £300 billion sitting in cash Isas would generate better returns - and help Labour's growth mission - if it was instead invested in the much riskier stock market .

Read more »

Martin Lewis Reveals Two Legal Methods to Avoid Paying Tax on SavingsFinancial expert Martin Lewis shares two legal strategies to minimize taxes on savings, including utilizing cash ISAs and Premium Bonds.

Martin Lewis Reveals Two Legal Methods to Avoid Paying Tax on SavingsFinancial expert Martin Lewis shares two legal strategies to minimize taxes on savings, including utilizing cash ISAs and Premium Bonds.

Read more »