The future of Cash ISAs in the UK is uncertain as city firms push for their abolition, arguing that they encourage low returns and should be replaced by stocks and shares ISAs. Building societies strongly oppose this move, highlighting the crucial role Cash ISAs play for individuals saving for short-term goals and protecting them from higher taxes.

Cash ISAs (Individual Savings Accounts) are a popular savings vehicle in the UK, allowing individuals to earn interest on their deposits without incurring any tax liabilities. Each year, savers can contribute up to £20,000 into a Cash ISA, a limit that has been a key factor in their widespread adoption. According to HMRC data, approximately 18 million people hold Cash ISAs, highlighting their significance in the UK's savings landscape.

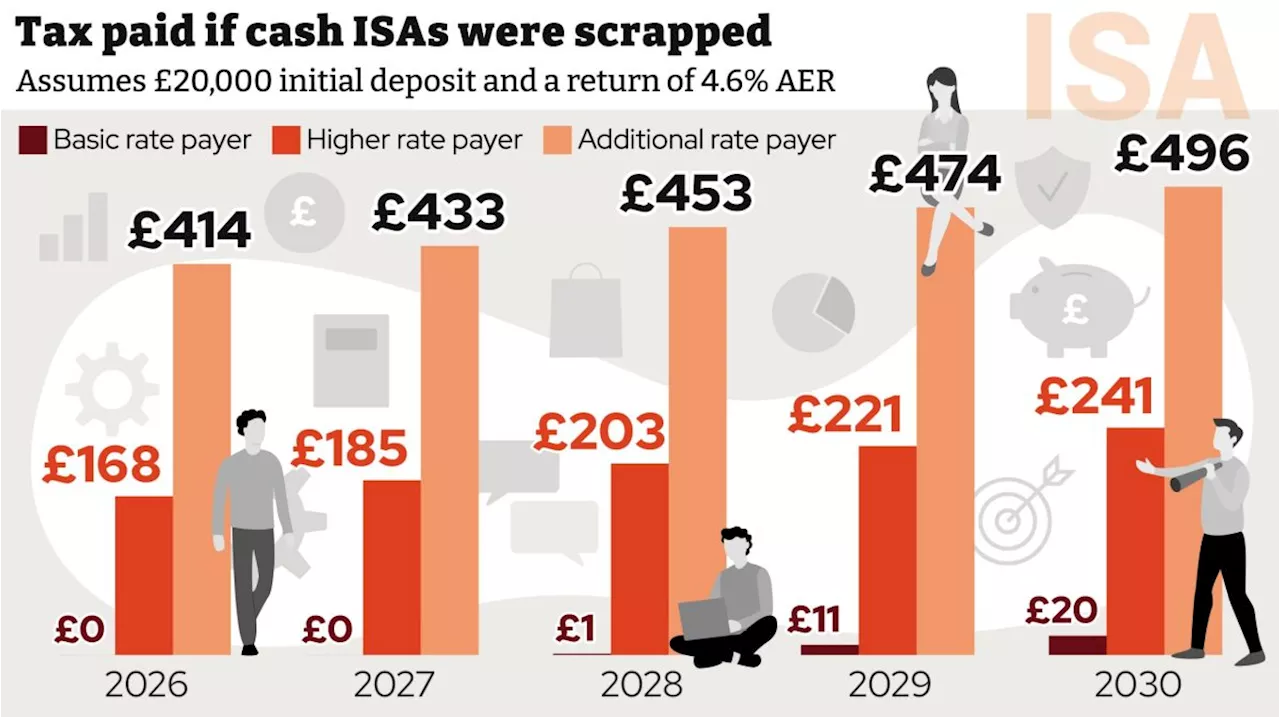

However, recent weeks have witnessed a growing controversy surrounding the future of Cash ISAs. City firms have reportedly pressured the Chancellor to abolish them, arguing that encouraging investments in stocks and shares ISAs would yield better returns for savers and bolster the London stock market.Building societies, on the other hand, have fiercely defended Cash ISAs, contending that eliminating them would disproportionately burden individuals who prioritize short-term savings goals. They argue that investing in stocks and shares carries inherent risks due to market fluctuations, making it unsuitable for those with immediate financial needs. Supporters of Cash ISAs emphasize their role in helping individuals achieve their savings objectives, particularly for essential life events such as purchasing a home or covering unexpected expenses. The debate intensifies when considering the potential tax implications. Calculations reveal that higher-rate taxpayers (earning over £50,270) could face a cumulative tax bill of £1,017.25 over the next five years if Cash ISAs were abolished and their £20,000 savings were instead placed in a conventional savings account. Those earning over £125,140 (additional rate taxpayers) could incur an even higher tax liability of £2,269.40. These figures are based on an initial deposit of £20,000 into a top-performing five-year savings account with an interest rate of 4.6%. Cash ISAs currently offer a tax-free haven for short-term savings, protecting their growth from income tax

CASH Isas UK Savings Tax-Free Savings Stocks And Shares Isas Financial Planning Building Societies Chancellor HMRC

United Kingdom Latest News, United Kingdom Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Cash Isa Tax Break Cuts Seen Triggering Mortgage CrisisThe UK Chancellor, Rachel Reeves, is facing warnings that reducing tax benefits on cash Isas could lead to a surge in mortgage rates and a housing market downturn. City firms argue that the nearly £300 billion held in cash Isas could generate better returns if invested in the stock market, but building societies warn that such a move would restrict lending and push up prices for homebuyers.

Cash Isa Tax Break Cuts Seen Triggering Mortgage CrisisThe UK Chancellor, Rachel Reeves, is facing warnings that reducing tax benefits on cash Isas could lead to a surge in mortgage rates and a housing market downturn. City firms argue that the nearly £300 billion held in cash Isas could generate better returns if invested in the stock market, but building societies warn that such a move would restrict lending and push up prices for homebuyers.

Read more »

Hands off our cash ISAs! Chancellor warned proposal to slash amount that can be put in tax-free...Major firms argue that almost £300 billion sitting in cash Isas would generate better returns - and help Labour's growth mission - if it was instead invested in the much riskier stock market .

Hands off our cash ISAs! Chancellor warned proposal to slash amount that can be put in tax-free...Major firms argue that almost £300 billion sitting in cash Isas would generate better returns - and help Labour's growth mission - if it was instead invested in the much riskier stock market .

Read more »

Martin Lewis Reveals Two Legal Methods to Avoid Paying Tax on SavingsFinancial expert Martin Lewis shares two legal strategies to minimize taxes on savings, including utilizing cash ISAs and Premium Bonds.

Martin Lewis Reveals Two Legal Methods to Avoid Paying Tax on SavingsFinancial expert Martin Lewis shares two legal strategies to minimize taxes on savings, including utilizing cash ISAs and Premium Bonds.

Read more »

TSB and Halifax Clarify Important Savings Limits Rules for CustomersTSB Bank and Halifax have recently provided clarity on crucial savings limits rules for their customers, responding to queries about making payments and managing Individual Savings Accounts (ISAs). TSB addressed limits on external transfers from savings accounts and outlined the daily transfer limits for current accounts. Halifax explained the rules surrounding reactivating existing ISAs after opening new ones with other providers within the same tax year.

TSB and Halifax Clarify Important Savings Limits Rules for CustomersTSB Bank and Halifax have recently provided clarity on crucial savings limits rules for their customers, responding to queries about making payments and managing Individual Savings Accounts (ISAs). TSB addressed limits on external transfers from savings accounts and outlined the daily transfer limits for current accounts. Halifax explained the rules surrounding reactivating existing ISAs after opening new ones with other providers within the same tax year.

Read more »

UK Warns Private Security Firms Against Working with Hostile States, Citing China as 'Threat'New Home Office guidance warns private security firms in the UK against deliberately working for hostile state actors, including China, following the passing of the National Security Act 2023. The advice highlights the threat posed by China and urges security professionals to conduct due diligence to avoid breaching national security laws. The guidance comes amid ongoing efforts by the UK government to balance national security concerns with economic ties to China.

UK Warns Private Security Firms Against Working with Hostile States, Citing China as 'Threat'New Home Office guidance warns private security firms in the UK against deliberately working for hostile state actors, including China, following the passing of the National Security Act 2023. The advice highlights the threat posed by China and urges security professionals to conduct due diligence to avoid breaching national security laws. The guidance comes amid ongoing efforts by the UK government to balance national security concerns with economic ties to China.

Read more »

Death threats by WhatsApp: extortion drains Peruvians’ cashFrom barbers to private schools, businesses and individuals are forced to send payments to criminals active across the region

Death threats by WhatsApp: extortion drains Peruvians’ cashFrom barbers to private schools, businesses and individuals are forced to send payments to criminals active across the region

Read more »