With dovish signals from the European Central Bank’s (ECB) major European counterparts (the Bank of England and Swiss National Bank) and investors' nerves still quite jittery on EU fiscal and political developments, the Euro is understandably under some pressure in the latter half of this week, Francesco Pesole, FX Strategist at ING argues.

With dovish signals from the European Central Bank’s major European counterparts and investors' nerves still quite jittery on EU fiscal and political developments, the Euro is understandably under some pressure in the latter half of this week, Francesco Pesole, FX Strategist at ING argues. EU activity indicators proved favorable for the Euro “What had come to the help of the common currency in some instances recently was decent activity indicators, and PMIs are released today.

It will be interesting to see whether political uncertainty in France has already taken a toll on French business sentiment at all: consensus doesn’t believe so.” “We’ll hear from two ECB members today – Gediminas Simkus and the hawk Joachim Nagel – who couldmove the market on comments about the current turmoil in EU bond markets.” “We still think EUR/USD can trade a bit lower into the US core PCE/French election events in late June. Risks of multiple days of trading below 1.07 are tangible.

United Kingdom Latest News, United Kingdom Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

EUR/USD Forecast: EUR/USD holds in range after a disappointing US ADP surveyFinancial markets were mostly quiet throughout the first half of the day, with the US Dollar achieving modest intraday gains amid prevalent caution.

EUR/USD Forecast: EUR/USD holds in range after a disappointing US ADP surveyFinancial markets were mostly quiet throughout the first half of the day, with the US Dollar achieving modest intraday gains amid prevalent caution.

Read more »

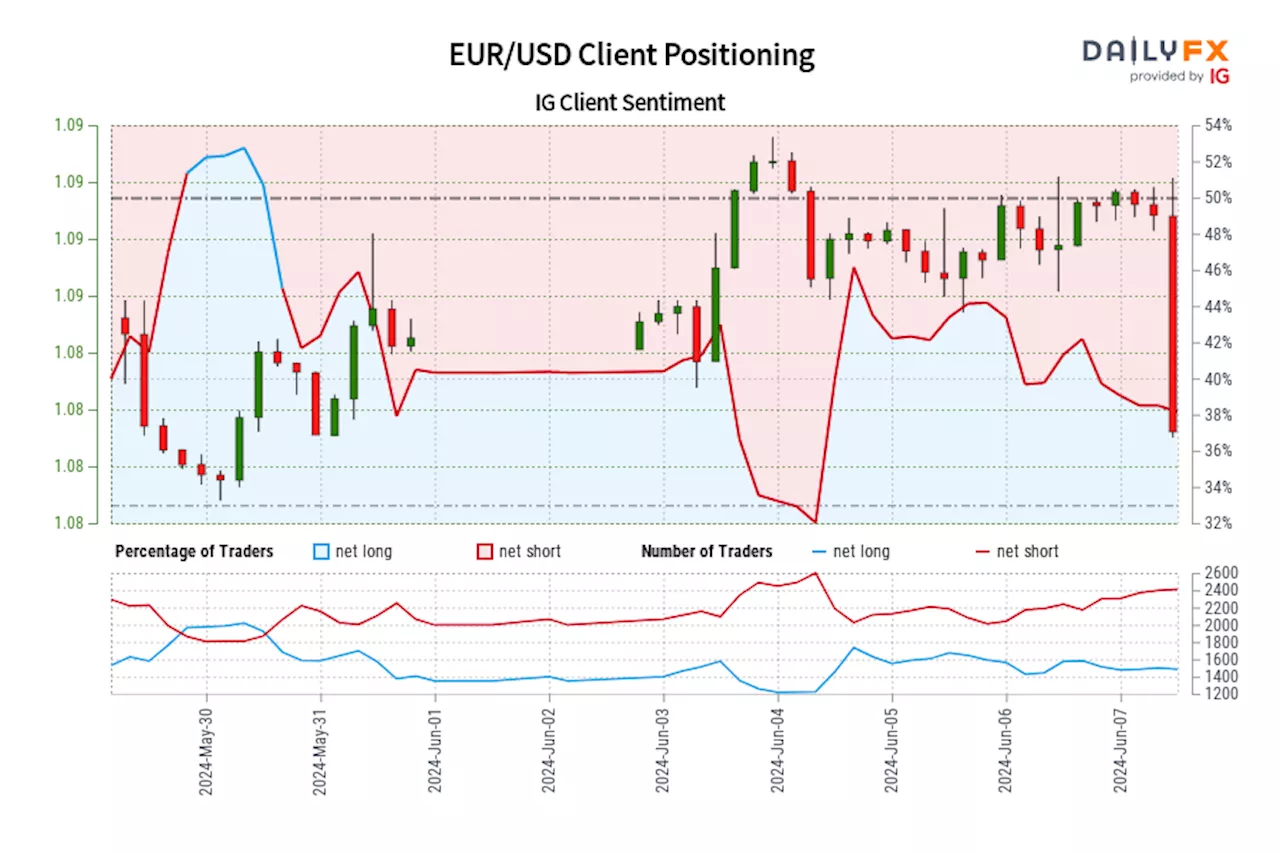

EUR/USD IG Client Sentiment: Our data shows traders are now net-long EUR/USD for the first time since May 30, 2024 13:00 GMT when EUR/USD traded near 1.08.Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/USD-bearish contrarian trading bias.

EUR/USD IG Client Sentiment: Our data shows traders are now net-long EUR/USD for the first time since May 30, 2024 13:00 GMT when EUR/USD traded near 1.08.Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/USD-bearish contrarian trading bias.

Read more »

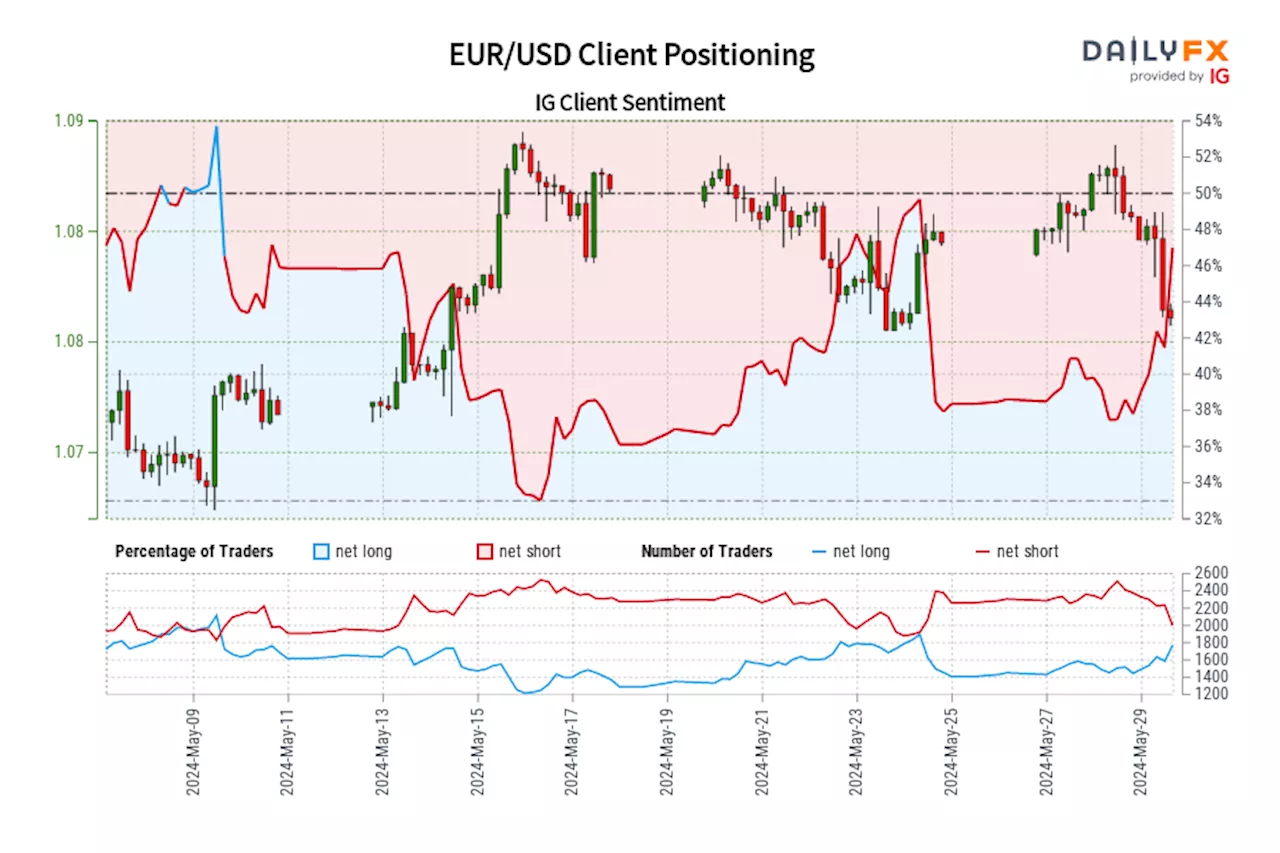

EUR/USD IG Client Sentiment: Our data shows traders are now net-long EUR/USD for the first time since May 09, 2024 when EUR/USD traded near 1.08.Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/USD-bearish contrarian trading bias.

EUR/USD IG Client Sentiment: Our data shows traders are now net-long EUR/USD for the first time since May 09, 2024 when EUR/USD traded near 1.08.Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/USD-bearish contrarian trading bias.

Read more »

EUR/USD recovery stalls near 1.0740 amid uncertainty ahead of US Retail SalesEUR/USD struggles to extend recovery above 1.0740 in Tuesday’s European session.

EUR/USD recovery stalls near 1.0740 amid uncertainty ahead of US Retail SalesEUR/USD struggles to extend recovery above 1.0740 in Tuesday’s European session.

Read more »

EUR/USD remains vulnerable amid EU political instabilityEUR/USD shows weakness near the immediate support of 1.0730 in Tuesday’s European session.

EUR/USD remains vulnerable amid EU political instabilityEUR/USD shows weakness near the immediate support of 1.0730 in Tuesday’s European session.

Read more »

EUR/USD juggles around 1.0900 as US NFP comes under spotlightEUR/USD trades sideways near 1.0900 in Friday’s European session.

EUR/USD juggles around 1.0900 as US NFP comes under spotlightEUR/USD trades sideways near 1.0900 in Friday’s European session.

Read more »