The Euro extends its losses against the US Dollar, with most European markets being closed in observance of Easter Monday.

EUR/USD declines following upbeat US Manufacturing PMI and Prices Paid Index, hinting the Fed might refrain from easing policy. The rise in the US Dollar Index and Treasury yields reflects growing confidence in the US economic outlook. Upcoming Eurozone manufacturing PMIs could push the EUR/USD further down, with estimates expected to contract further. Data from the United States sponsored a leg down in the EUR/USD, which tumbled more than 0.40% and traded at 1.0742.

93, while US Treasury yields rise. The 10-year benchmark note rate is at 4.305%, up almost ten basis points. Following the data release, money market traders see a 61% chance of the Fed cutting rates by 25 basis points, as depicted via the CME FedWatch Tool. Across the pond, the Eurozone economic docket will feature the release of the HCOB manufacturing PMI for Spain, Italy, France, Germany, and the whole bloc.

United Kingdom Latest News, United Kingdom Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

EUR/USD trades on a weaker note below 1.0800, investors await the US PMI dataThe EUR/USD pair trades on a weaker note near 1.0787 on the renewed US dollar (USD) demand during the early Asian session on Monday.

EUR/USD trades on a weaker note below 1.0800, investors await the US PMI dataThe EUR/USD pair trades on a weaker note near 1.0787 on the renewed US dollar (USD) demand during the early Asian session on Monday.

Read more »

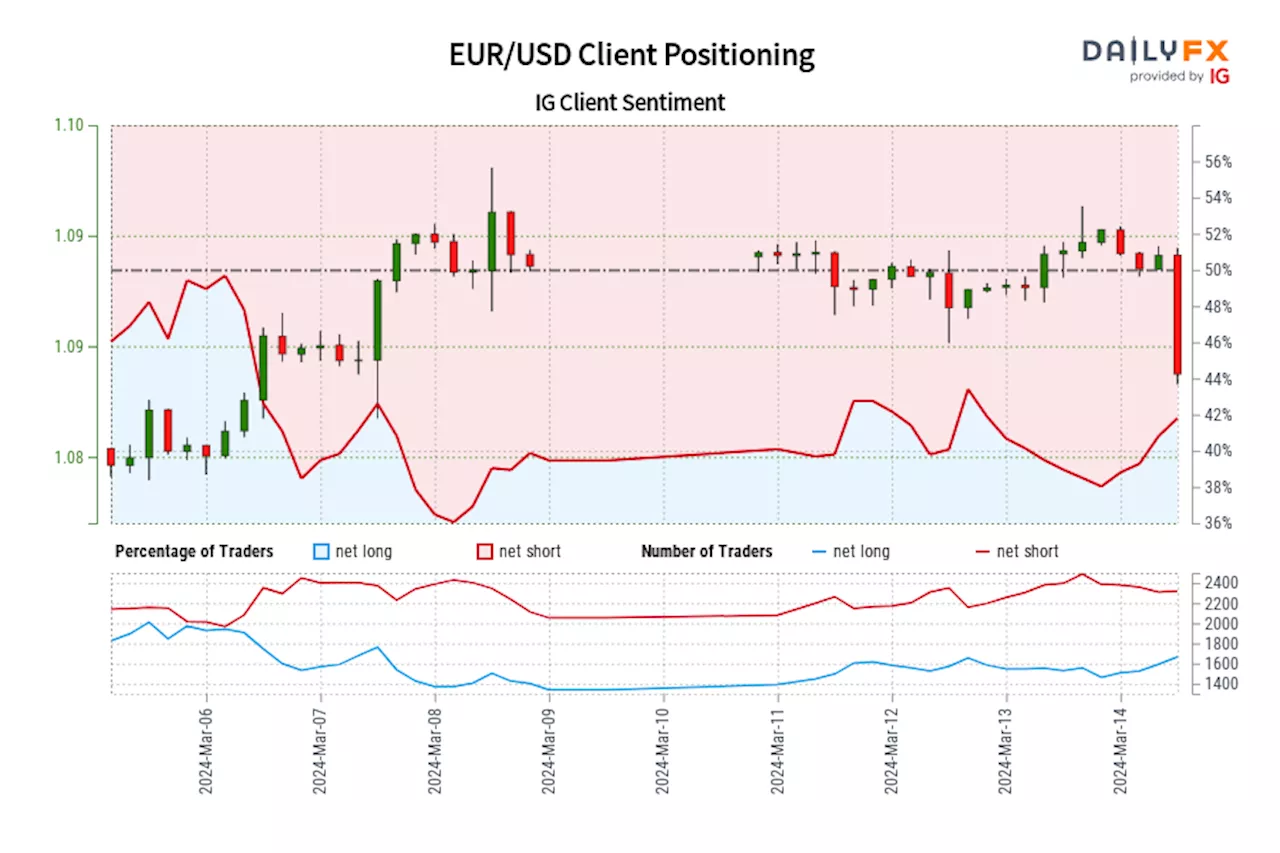

EUR/USD IG Client Sentiment: Our data shows traders are now net-long EUR/USD for the first time since Mar 06, 2024 03:00 GMT when EUR/USD traded near 1.09.Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/USD-bearish contrarian trading bias.

EUR/USD IG Client Sentiment: Our data shows traders are now net-long EUR/USD for the first time since Mar 06, 2024 03:00 GMT when EUR/USD traded near 1.09.Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/USD-bearish contrarian trading bias.

Read more »

GBP/USD hovers around 1.2530 after paring gains, focus on US ISM Manufacturing PMIGBP/USD trims intraday gains, remaining higher around 1.2530 during the Asian hours on Monday.

GBP/USD hovers around 1.2530 after paring gains, focus on US ISM Manufacturing PMIGBP/USD trims intraday gains, remaining higher around 1.2530 during the Asian hours on Monday.

Read more »

US ISM Manufacturing PMI improves to 50.3 in March vs. 48.4 expectedBusiness activity in the US manufacturing sector expanded at a modest pace in March, with the ISM Manufacturing PMI rising to 50.3 from 47.8 in February.

US ISM Manufacturing PMI improves to 50.3 in March vs. 48.4 expectedBusiness activity in the US manufacturing sector expanded at a modest pace in March, with the ISM Manufacturing PMI rising to 50.3 from 47.8 in February.

Read more »

EUR/USD Price Analysis: Maintains position below the psychological level of 1.0800EUR/USD pares intraday gains, trading higher around 1.0780 during the Asian session on Monday.

EUR/USD Price Analysis: Maintains position below the psychological level of 1.0800EUR/USD pares intraday gains, trading higher around 1.0780 during the Asian session on Monday.

Read more »

EUR/USD dips below 1.0800 amid ECB dovish dovish signal and strong US GDP figuresThe Euro extends its losses against the US Dollar, with the major diving below the 1.0800 figure, following dovish comments by European Central Bank (ECB) policymaker Francois Villeroy.

EUR/USD dips below 1.0800 amid ECB dovish dovish signal and strong US GDP figuresThe Euro extends its losses against the US Dollar, with the major diving below the 1.0800 figure, following dovish comments by European Central Bank (ECB) policymaker Francois Villeroy.

Read more »