EUR/USD continues to settle closer to 1.0800 after a misfire in market expectations of Federal Reserve (Fed) Chairman Jerome Powell’s testimony before US Congress on Tuesday.

EUR/USD continues to chill after testing above 1.0840 this week. Fed speak from Fed Chair Powell failed to deliver a dovish-enough stance. US inflation data to be the key print later in the week. EUR/USD continues to settle closer to 1.0800 after a misfire in market expectations of Fed eral Reserve Chairman Jerome Powell’s testimony before US Congress on Tuesday.

In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day. EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY , EUR/GBP and EUR/AUD . What is the ECB and how does it impact the Euro? The European Central Bank in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy.

United Kingdom Latest News, United Kingdom Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

EUR/USD: Topside for EUR/USD is very limited – Societe GeneraleThis morning’s IFO data confirm what the PMIs told us – expectations are down, FX strategist Kit Juckes at Societe Generale notes.

EUR/USD: Topside for EUR/USD is very limited – Societe GeneraleThis morning’s IFO data confirm what the PMIs told us – expectations are down, FX strategist Kit Juckes at Societe Generale notes.

Read more »

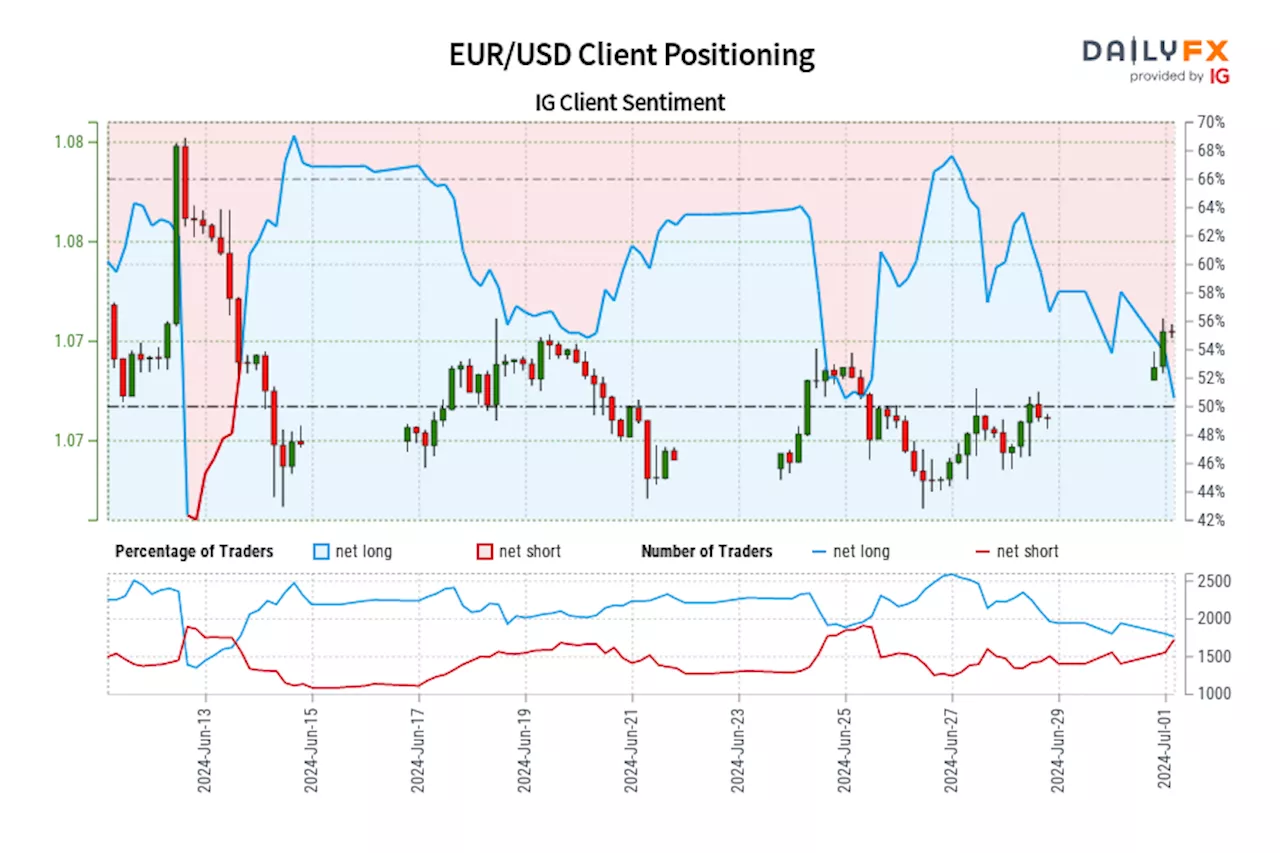

EUR/USD IG Client Sentiment: Our data shows traders are now net-short EUR/USD for the first time since Jun 13, 2024 when EUR/USD traded near 1.07.Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/USD-bullish contrarian trading bias.

EUR/USD IG Client Sentiment: Our data shows traders are now net-short EUR/USD for the first time since Jun 13, 2024 when EUR/USD traded near 1.07.Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/USD-bullish contrarian trading bias.

Read more »

EUR/USD clings to gains on firm Fed rate-cut prospectsEUR/USD extends its recovery to 1.0740 in Tuesday’s European session.

EUR/USD clings to gains on firm Fed rate-cut prospectsEUR/USD extends its recovery to 1.0740 in Tuesday’s European session.

Read more »

EUR/USD aims to gain ground above 1.0700 as Fed rate-cut bets riseEUR/USD consolidates in a tight range above the round-level support of 1.0700 in Wednesday’s European session.

EUR/USD aims to gain ground above 1.0700 as Fed rate-cut bets riseEUR/USD consolidates in a tight range above the round-level support of 1.0700 in Wednesday’s European session.

Read more »

EUR/USD grinds between firms Fed rate-cut hopes and Officials' hawkish remarksEUR/USD trades in a tight range near the crucial support of 1.0700 in Monday’s early European session.

EUR/USD grinds between firms Fed rate-cut hopes and Officials' hawkish remarksEUR/USD trades in a tight range near the crucial support of 1.0700 in Monday’s early European session.

Read more »

EUR/USD edges higher as traders brace for US inflation, Fed’s decisionEUR/USD edges higher to 1.0750 in Wednesday’s European session ahead of the United States (US) Consumer Price Index (CPI) data for May and the Federal Reserve’s (Fed) interest rate decision, which are scheduled for the American session.

EUR/USD edges higher as traders brace for US inflation, Fed’s decisionEUR/USD edges higher to 1.0750 in Wednesday’s European session ahead of the United States (US) Consumer Price Index (CPI) data for May and the Federal Reserve’s (Fed) interest rate decision, which are scheduled for the American session.

Read more »