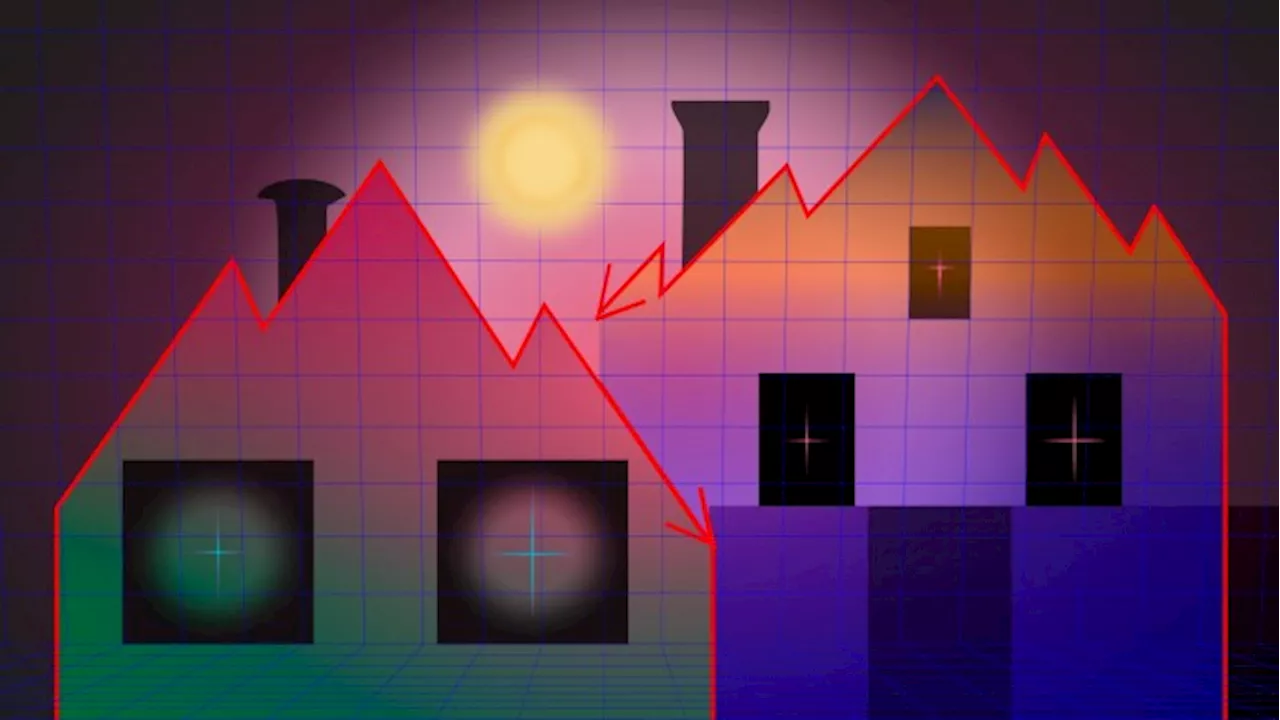

Donald Trump's announcement of new tariffs, targeting imports from a range of countries including the EU, has sent shockwaves through global markets. The South African rand has plummeted, while the FTSE 100 Index has suffered a significant drop. World leaders have voiced concerns over the potential economic fallout, with some advocating for retaliation while others urge caution and dialogue.

will host a live Q&A on Donald Trump 's tariffs announcement.South African rand slumps after Trump says he will cut off funding

He said South Africa was confiscating land, about a week after President Cyril Ramaphosa signed into law legislation that allows the state to expropriate land in the public interest under certain circumstances. Villeroy, who is also a European Central Bank policymaker, said Trump's tariffs were"very brutal" and would hit the autos sector especially.

Canadian sports fans booed the US national anthem at a sports event over the weekend hours after Donald Trump followed through on his threats regarding import tariffs. "You're talking about big economic consequences for America, Canada, Mexico, China and for the rest of the world," he adds.Following on from our last post, a look at the London's FTSE 100 Index shows it has tumbled more than 1% on opening after Donald Trump announced a wave of tariffs and warned the EU would be next.

TARIFFS TRADEWAR GLOBAL MARKETS ECONOMICS DONALD TRUMP

United Kingdom Latest News, United Kingdom Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Trump's Impact on Global Markets: Will History Repeat?This article explores the potential impact of Donald Trump's return to power on global markets, arguing that focusing solely on him as a predictor is shortsighted. It highlights historical examples where presidents' influence on markets has been less than expected and suggests that global economic cycles and competitive shifts could lead to significant changes in 2025.

Trump's Impact on Global Markets: Will History Repeat?This article explores the potential impact of Donald Trump's return to power on global markets, arguing that focusing solely on him as a predictor is shortsighted. It highlights historical examples where presidents' influence on markets has been less than expected and suggests that global economic cycles and competitive shifts could lead to significant changes in 2025.

Read more »

UK Markets Rocked As Sterling Tumbles and Borrowing Costs SurgeChancellor Rachel Reeves faces mounting pressure as the Pound weakens and government borrowing costs soar to their highest level since 2008. Economists warn that the situation is more dire than after Liz Truss's mini-Budget, with fears of a potential 1976 IMF bailout. Reeves is facing a difficult choice between slashing spending or raising taxes to meet her fiscal rules.

UK Markets Rocked As Sterling Tumbles and Borrowing Costs SurgeChancellor Rachel Reeves faces mounting pressure as the Pound weakens and government borrowing costs soar to their highest level since 2008. Economists warn that the situation is more dire than after Liz Truss's mini-Budget, with fears of a potential 1976 IMF bailout. Reeves is facing a difficult choice between slashing spending or raising taxes to meet her fiscal rules.

Read more »

Oil Markets Rocked by Sanctions and Geopolitical TensionsGlobal oil markets are experiencing volatility due to several factors, including the Biden administration's sanctions against Russia's shadow fleet, rising demand from Asian refiners, and geopolitical uncertainties surrounding Libya and Colombia.

Oil Markets Rocked by Sanctions and Geopolitical TensionsGlobal oil markets are experiencing volatility due to several factors, including the Biden administration's sanctions against Russia's shadow fleet, rising demand from Asian refiners, and geopolitical uncertainties surrounding Libya and Colombia.

Read more »

Trump's Continued Influence on Markets: A Contrarian ViewThis article challenges the assumption that Donald Trump's return to the political scene will dictate global economic and market trends. It argues that history shows the impact of US presidents on markets is often unpredictable and that relying on a single factor for forecasting is risky. The author suggests that contrary to expectations, Trump 2.0 may not play out as anticipated and highlights the cyclical nature of global markets, urging a contrarian approach to investing.

Trump's Continued Influence on Markets: A Contrarian ViewThis article challenges the assumption that Donald Trump's return to the political scene will dictate global economic and market trends. It argues that history shows the impact of US presidents on markets is often unpredictable and that relying on a single factor for forecasting is risky. The author suggests that contrary to expectations, Trump 2.0 may not play out as anticipated and highlights the cyclical nature of global markets, urging a contrarian approach to investing.

Read more »

Will US markets keep rising under Trump?Economic uncertainty and frothy valuations jar with investor optimism

Will US markets keep rising under Trump?Economic uncertainty and frothy valuations jar with investor optimism

Read more »

The bond markets vs Donald TrumpThere is a notable — and rising — risk of financial turmoil if the new White House does anything to spook investors

The bond markets vs Donald TrumpThere is a notable — and rising — risk of financial turmoil if the new White House does anything to spook investors

Read more »