A group of institutional investors with $1.5 trillion in assets has issued an ultimatum to asset managers, urging them to prioritize climate action or risk losing their business. This move highlights the growing divide within the investment industry regarding how to manage the financial risks associated with global warming.

Institutional investors managing $1.5 trillion in funds have issued a stark ultimatum to asset managers : prioritize climate action or risk losing their business. This signal of division within the investment industry highlights the growing debate over how to manage the financial risks associated with global warming .

A coalition of 26 financial institutions and pension funds spanning from Australia to the United States, including prominent players like Scottish Widows, the People’s Partnership, and Brunel Pension Partnership, have demanded that their asset managers take a more proactive stance in engaging companies they invest in regarding their climate risks. The election of Donald Trump, who has dismissed climate change as a hoax, and the subsequent pushback against environmental, social, and governance (ESG) investing by Republican governors in the US, have prompted many large asset managers to retreat from publicly advocating for corporate action on climate change. However, this group of asset owners argues that climate change presents a long-term financial risk, particularly for pension funds that will be responsible for paying out retirement income for decades to come. Leanne Clements, Head of Responsible Investment at the People’s Partnership, one of the largest UK workplace pension providers with 6 million members, emphasized this point, stating, “We are long-term investors. Ultimately, the financial material arguments for climate change rise above short-term political challenges.” She stressed the importance of asset owners maintaining their commitment to climate action and holding their fund managers accountable for implementing robust climate stewardship strategies that ultimately deliver value for their members.The group has laid out a series of expectations for their asset managers, which will be factored into their performance evaluations, with the threat of downgrading or withdrawing funds if these expectations are not met. Beyond the threat of losing their business, the group has requested that the stewardship function at asset managers, responsible for interacting with companies they invest in, be adequately resourced. “Poor or misaligned stewardship activity” could result in a downgrade in asset manager ratings, a review of the mandate, or the selection of a different asset manager demonstrating “greater alignment with the pension scheme’s objectives,” the group stated. Asset managers are also expected to demonstrate a systematic approach to voting on climate-related issues at shareholder meetings. Previous research in 2023 revealed varying degrees of “misalignment” between the voting records of major asset managers and their clients’ long-term objectives, particularly concerning US oil and gas investments. Asset managers led by BlackRock have recently withdrawn from industry coalitions on climate action, such as the Net-Zero Asset Owners Alliance and Climate Action 100+, facing accusations of anti-competitive behavior. In recent weeks, large UK pension funds, including Nest, the government-established workplace pension scheme, have disclosed their involvement in discussions with asset managers regarding their exit from these industry organizations. Faith Ward, Responsible Investment Officer at Brunel Pension Partnership, which manages the pension assets of 10 local government schemes across the UK, highlighted the potential for a disconnect between asset managers' short-term focus and the long-term needs of their clients. She emphasized that these asset managers are entrusted with managing their money on their behalf, considering their liabilities. Furthermore, the green pensions campaign co-founded by filmmaker and activist Richard Curtis, Make My Money Matter, recently released a report revealing a persistent failure within the UK pensions sector to address its role in financing the climate crisis

Finance Climate Change Institutional Investors Asset Managers Climate Action ESG Investing Financial Risks Global Warming Pension Funds

United Kingdom Latest News, United Kingdom Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Giles Coren 'had to demand, literally demand' a test before cancer diagnosisFood critic Giles Coren revealed he had prostate cancer

Giles Coren 'had to demand, literally demand' a test before cancer diagnosisFood critic Giles Coren revealed he had prostate cancer

Read more »

Gold Demand Soars to Record Highs in 2024 Fueled by Central Bank and Investor AppetiteGlobal demand for gold reached an all-time high in 2024, hitting 4,974 tonnes and a value of $382 billion, driven by surging interest from central banks and investors seeking safe haven assets amid economic uncertainty. Central banks purchased over 1,000 tonnes of gold for the third consecutive year, with Poland, Turkey, and India leading the charge. Private investors also contributed to the demand surge, with investment in gold reaching a four-year high, largely driven by non-western economies. The report highlights a continued trend of investors seeking refuge in gold amidst geopolitical and economic volatility.

Gold Demand Soars to Record Highs in 2024 Fueled by Central Bank and Investor AppetiteGlobal demand for gold reached an all-time high in 2024, hitting 4,974 tonnes and a value of $382 billion, driven by surging interest from central banks and investors seeking safe haven assets amid economic uncertainty. Central banks purchased over 1,000 tonnes of gold for the third consecutive year, with Poland, Turkey, and India leading the charge. Private investors also contributed to the demand surge, with investment in gold reaching a four-year high, largely driven by non-western economies. The report highlights a continued trend of investors seeking refuge in gold amidst geopolitical and economic volatility.

Read more »

Historical Institutional Abuses survivors appeal to extend compensation schemeApplications to the Historical Institutional Abuse Redress Board are due to close on 2 April.

Historical Institutional Abuses survivors appeal to extend compensation schemeApplications to the Historical Institutional Abuse Redress Board are due to close on 2 April.

Read more »

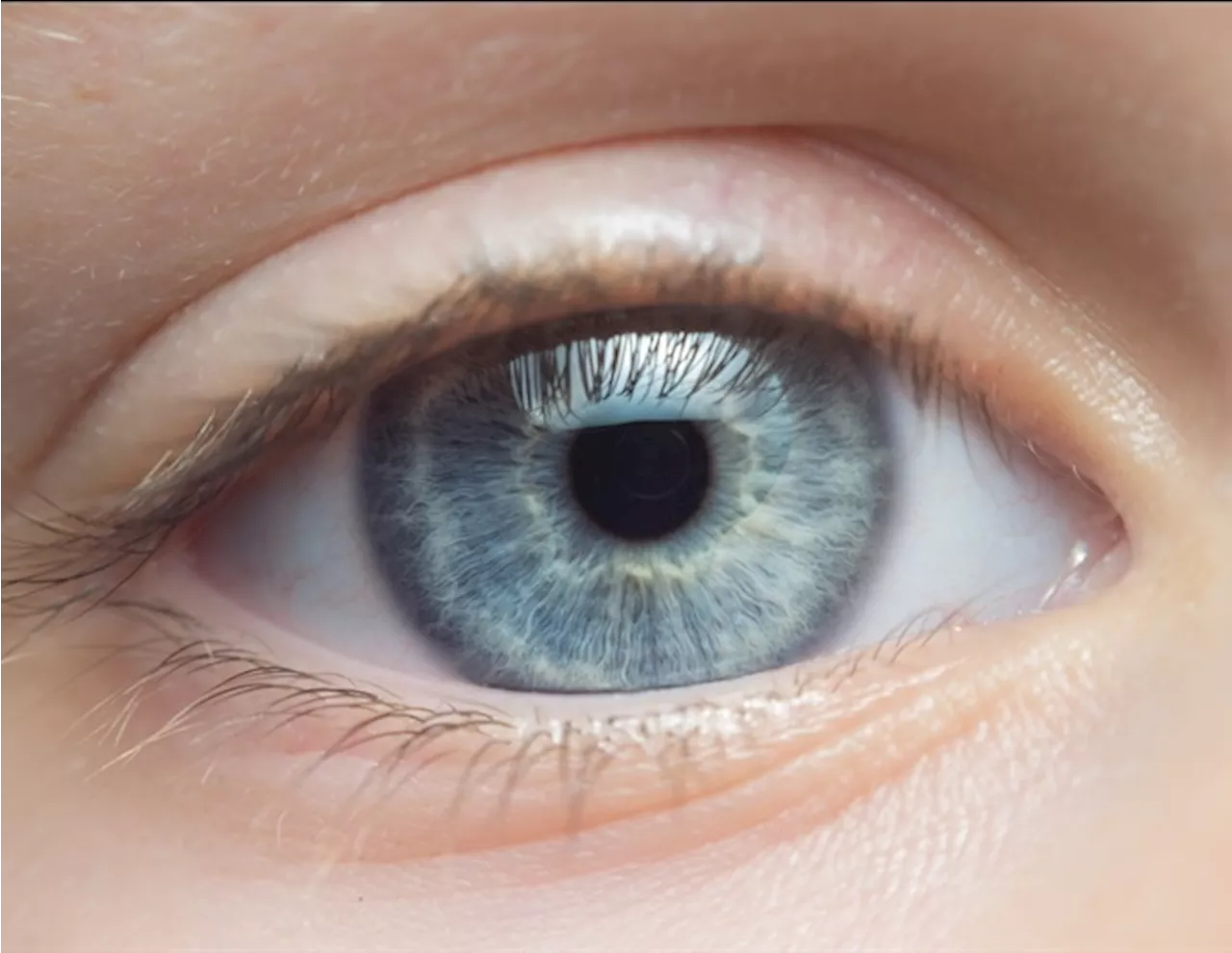

NYU Langone Leads Multi-Institutional Effort to Make Vision-Restoring Whole-Eye Transplants a RealityA groundbreaking project brings together leading experts from NYU Langone Health, NYU Grossman School of Medicine, and other institutions across the U.S. to advance vision-restoring whole-eye transplants.

NYU Langone Leads Multi-Institutional Effort to Make Vision-Restoring Whole-Eye Transplants a RealityA groundbreaking project brings together leading experts from NYU Langone Health, NYU Grossman School of Medicine, and other institutions across the U.S. to advance vision-restoring whole-eye transplants.

Read more »

VMware's Institutional Stickiness: Is Broadcom's Grip Too Strong?This article explores the reasons behind VMware customers' reluctance to migrate despite Broadcom's aggressive licensing practices. While some attribute it to 'Stockholm syndrome,' Gartner analyst suggests that a key factor is the lack of clarity surrounding existing VMware deployments and the complexity of evaluating alternatives. The article emphasizes the importance of proactive planning and technical evaluation of options to avoid vendor lock-in and the potential risks associated with migrating to unfamiliar solutions.

VMware's Institutional Stickiness: Is Broadcom's Grip Too Strong?This article explores the reasons behind VMware customers' reluctance to migrate despite Broadcom's aggressive licensing practices. While some attribute it to 'Stockholm syndrome,' Gartner analyst suggests that a key factor is the lack of clarity surrounding existing VMware deployments and the complexity of evaluating alternatives. The article emphasizes the importance of proactive planning and technical evaluation of options to avoid vendor lock-in and the potential risks associated with migrating to unfamiliar solutions.

Read more »

Victims of Glasgow paedophile sex gang let down by 'institutional failures'Ash Regan said the horrific case 'reeked of institutional failures' as three abuse victims were already known to child protection services before a police investigation was launched.

Victims of Glasgow paedophile sex gang let down by 'institutional failures'Ash Regan said the horrific case 'reeked of institutional failures' as three abuse victims were already known to child protection services before a police investigation was launched.

Read more »