Lloyds Banking Group announced the closure of 136 branches across the UK, attributing the decision to the shift towards mobile banking and online services. While customers will still have access to telephone banking, community bankers, and Halifax, Lloyds, and Bank of Scotland branches, the closures raise concerns about the availability of cash services in local communities.

LLOYDS Banking Group has announced that it will be shutting a total of 136 branches across the UK high street.Lloyds blamed the decision to shut the branches on customers shifting away from banking in person to using mobile services."Alongside our apps, customers can also use telephone banking, visit a community banker or use any Halifax, Lloyds or Bank of Scotland branch, giving access to many more branches.

Banks and building societies have closed 6,161 branches since January 2015 at a rate of around 53 each month, according to Which?.Once all previously announced closures are complete, Lloyds Banking Group will have a total of 757 branches - 386 Lloyds, 281 Halifax, and 90 Bank of Scotland.When they make changes, they need to check whether local communities will be left without important cash services, like branches or ATMs, and fix any significant gaps.

The vast majority of banking customers are moving online and don't need a physical branch as much as before.BANKING hubs offer a range of services to bridge the gap left by the closure of local branches. Each hub features private booths where customers can discuss more complex banking matters with staff from their respective banks.

BANKING BRANCH CLOSURES MOBILE BANKING CASH SERVICES COMMUNITIES

United Kingdom Latest News, United Kingdom Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Lloyds Banking Group to Close 136 BranchesLloyds Banking Group is shutting down 136 branches across its Lloyds, Halifax, and Bank of Scotland brands, citing a shift towards mobile banking. The closures will impact 61 Lloyds, 61 Halifax, and 14 Bank of Scotland branches between May this year and March 2026. The bank assures that affected employees will be offered alternative roles.

Lloyds Banking Group to Close 136 BranchesLloyds Banking Group is shutting down 136 branches across its Lloyds, Halifax, and Bank of Scotland brands, citing a shift towards mobile banking. The closures will impact 61 Lloyds, 61 Halifax, and 14 Bank of Scotland branches between May this year and March 2026. The bank assures that affected employees will be offered alternative roles.

Read more »

Lloyds, Halifax and Bank of Scotland makes HUGE change in bank branches...Inside the hubs restoring high street banking and reversing the tide of mass branch closures

Lloyds, Halifax and Bank of Scotland makes HUGE change in bank branches...Inside the hubs restoring high street banking and reversing the tide of mass branch closures

Read more »

Lloyds Banking Group Plans to Open Up Branches to All CustomersLloyds Banking Group aims to simplify customer access to banking services by allowing all customers to use any branch in its network, regardless of their bank affiliation. This move comes amidst a trend of bank branch closures in the UK and while Lloyds also emphasizes its focus on mobile banking, concerns have been raised by trade unions about potential job losses due to further branch closures.

Lloyds Banking Group Plans to Open Up Branches to All CustomersLloyds Banking Group aims to simplify customer access to banking services by allowing all customers to use any branch in its network, regardless of their bank affiliation. This move comes amidst a trend of bank branch closures in the UK and while Lloyds also emphasizes its focus on mobile banking, concerns have been raised by trade unions about potential job losses due to further branch closures.

Read more »

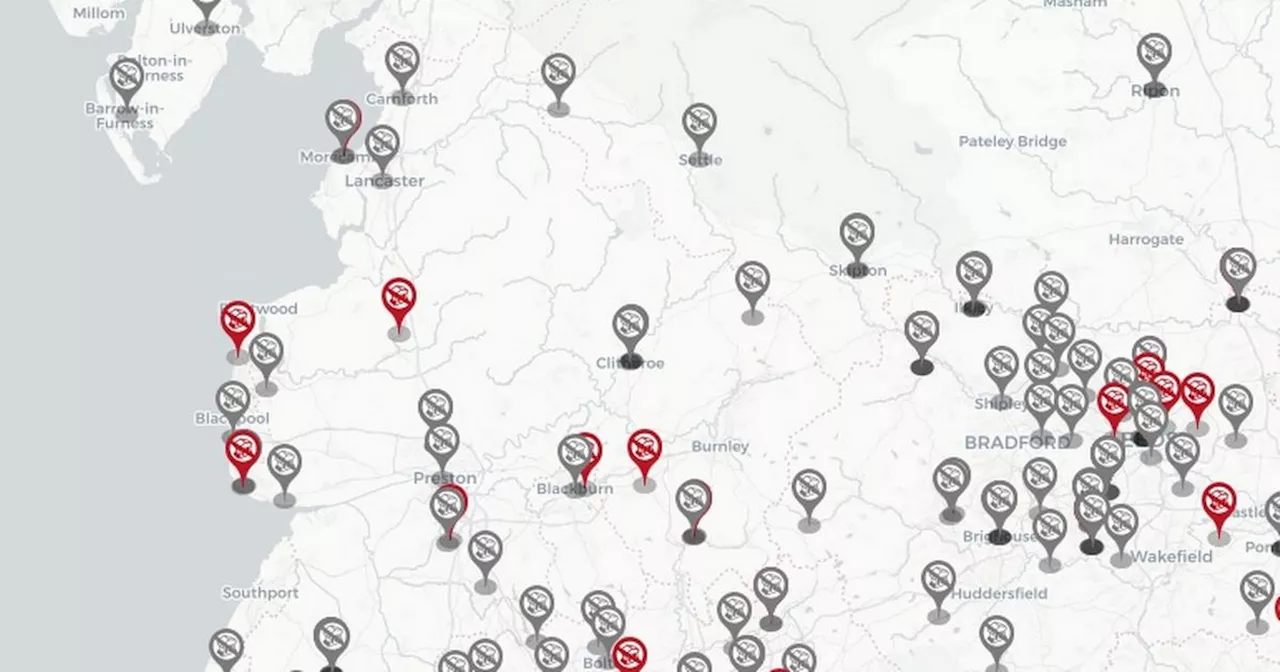

Mapped: The Lancashire areas where banks have disappearedBranches of Barclays, Halifax, NatWest, Lloyds, HSBC and RBS have all closed

Mapped: The Lancashire areas where banks have disappearedBranches of Barclays, Halifax, NatWest, Lloyds, HSBC and RBS have all closed

Read more »

NatWest to Close 53 More Branches in 2025, Including Seven in LancashireNatWest has announced plans to close 53 more branches in the first half of 2025, with seven closures scheduled in Lancashire. This follows a trend of branch closures in recent years, attributed to the increasing popularity of online banking. Despite the closures, NatWest will continue to offer alternative services such as mobile branches and community pop-up banks for customers who require face-to-face support. Customers can also access basic cash and counter services at local Post Offices.

NatWest to Close 53 More Branches in 2025, Including Seven in LancashireNatWest has announced plans to close 53 more branches in the first half of 2025, with seven closures scheduled in Lancashire. This follows a trend of branch closures in recent years, attributed to the increasing popularity of online banking. Despite the closures, NatWest will continue to offer alternative services such as mobile branches and community pop-up banks for customers who require face-to-face support. Customers can also access basic cash and counter services at local Post Offices.

Read more »

NatWest to Close Five Branches in NottinghamshireNatWest Group announced the closure of five branches across Nottinghamshire due to a significant shift in customer preferences towards digital banking. The bank reported a 62% decline in counter transactions and a 53% increase in mobile app usage between 2019 and 2024. NatWest plans to invest over £20 million this year to enhance its remaining branches and support customers transitioning to digital banking.

NatWest to Close Five Branches in NottinghamshireNatWest Group announced the closure of five branches across Nottinghamshire due to a significant shift in customer preferences towards digital banking. The bank reported a 62% decline in counter transactions and a 53% increase in mobile app usage between 2019 and 2024. NatWest plans to invest over £20 million this year to enhance its remaining branches and support customers transitioning to digital banking.

Read more »