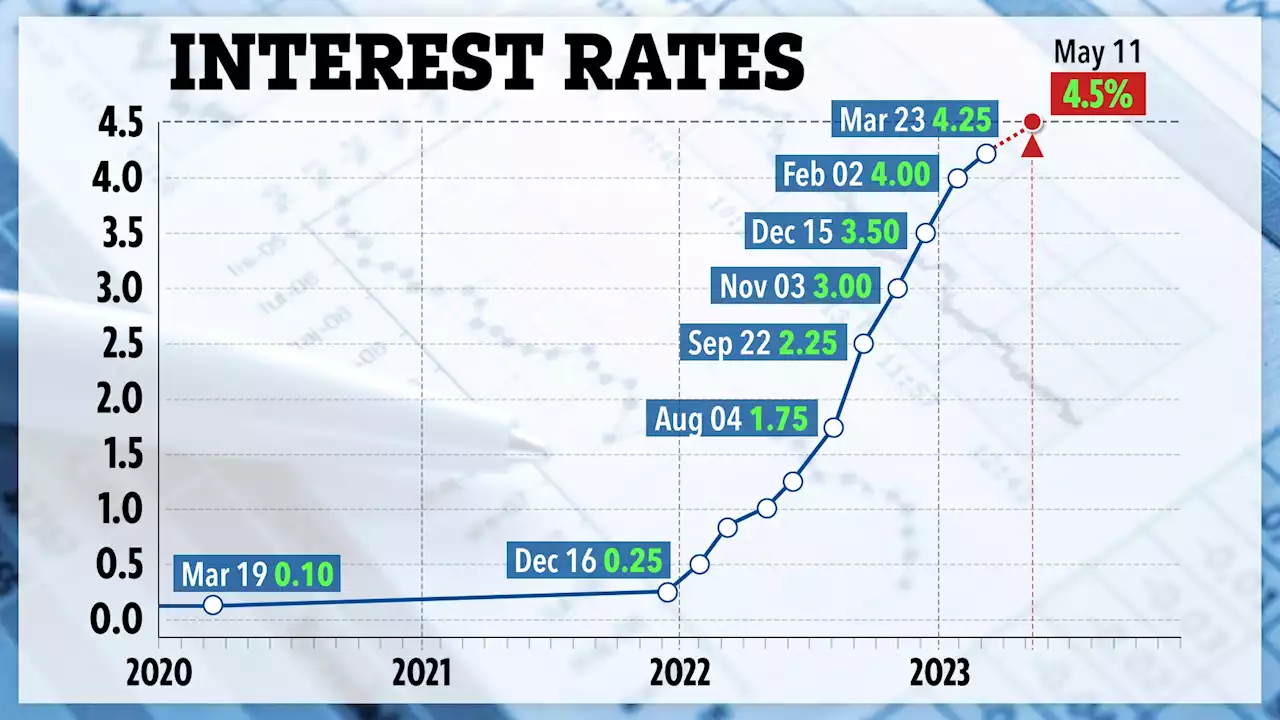

The Bank of England base rate has gone up from 4.25% to 4.5%, the highest level since 2008.

Martin Lewis has shared how the newly announced Bank of England interest rate of 4.5 per cent will impact on people with savings or a mortgage. The Bank increased the base rate for the 12th time in a row, taking it to the highest level since 2008.

For savers, he said: “Top paying easy access savings accounts will likely rise a tiny bit over the next few weeks . Most big bank savings will continue to pay diddly squat, so check, ditch & switch.” The Bank had previously thought Consumer Price Index I inflation could fall as low as 1 per cent by the middle of 2024 but it is now predicted to reach around 3.4 per cent.

“Those aiming to lock into a fixed-rate mortgage for peace of mind will find average rates have come down slightly over the past month, but as rates average around 5%, this may still be unaffordable for some. The average five-year fixed mortgage rate is lower than the two-year fixed, which may encourage prospective borrowers to lock down their rate for longer.

Latest Martin Lewis News Responding to the latest rate rise, Vikki Brownridge, Chief Executive of StepChange Debt Charity, said: “The steep jump in interest rates we’ve seen over the past 12 months has been a shock to household budgets, compounding financial difficulty for people who are already struggling to make ends meet.

United Kingdom Latest News, United Kingdom Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Bank of England hikes interest rates to 4.5% - its highest level since 2008BREAKING: Britain’s interest rates have risen to 4.5%, the Bank of England's highest level since 2008.

Bank of England hikes interest rates to 4.5% - its highest level since 2008BREAKING: Britain’s interest rates have risen to 4.5%, the Bank of England's highest level since 2008.

Read more »

‘We will not change Bank of England’s inflation target’ Treasury ministers vowFinancial watchdogs facing benchmarks to keep City competitive amid claims of 'unaccountable' regulators

‘We will not change Bank of England’s inflation target’ Treasury ministers vowFinancial watchdogs facing benchmarks to keep City competitive amid claims of 'unaccountable' regulators

Read more »

What the Bank of England's interest rate announcement this week means for youEconomists are concerned that the Base Rate could rise to the same levels it was at during the 2008 financial crisis

What the Bank of England's interest rate announcement this week means for youEconomists are concerned that the Base Rate could rise to the same levels it was at during the 2008 financial crisis

Read more »

Bank of England to impose another interest rate hike as UK inflation proves stubbornFinancial markets and economists have priced in another rate rise today and their focus will be on the Bank's updated forecasts for signs that a pause lies ahead.

Bank of England to impose another interest rate hike as UK inflation proves stubbornFinancial markets and economists have priced in another rate rise today and their focus will be on the Bank's updated forecasts for signs that a pause lies ahead.

Read more »

Mortgage warning for millions as Bank of England hikes interest rates AGAINMILLIONS of homeowners will face higher mortgage repayments after the Bank of England hiked interest rates again. The central bank’s base rate has increased from 4.25% to 4.5%. The rate is us…

Mortgage warning for millions as Bank of England hikes interest rates AGAINMILLIONS of homeowners will face higher mortgage repayments after the Bank of England hiked interest rates again. The central bank’s base rate has increased from 4.25% to 4.5%. The rate is us…

Read more »

House prices were going to fall anyway - the Bank of England is just helping them alongThe Bank of England is making it clear that the era of cheap credit is well and truly over While it’s unlikely that there will be a housing market crash like the one seen after the 2008 global financial crisis, a downturn is likely 🏠 Victoria_Spratt

House prices were going to fall anyway - the Bank of England is just helping them alongThe Bank of England is making it clear that the era of cheap credit is well and truly over While it’s unlikely that there will be a housing market crash like the one seen after the 2008 global financial crisis, a downturn is likely 🏠 Victoria_Spratt

Read more »