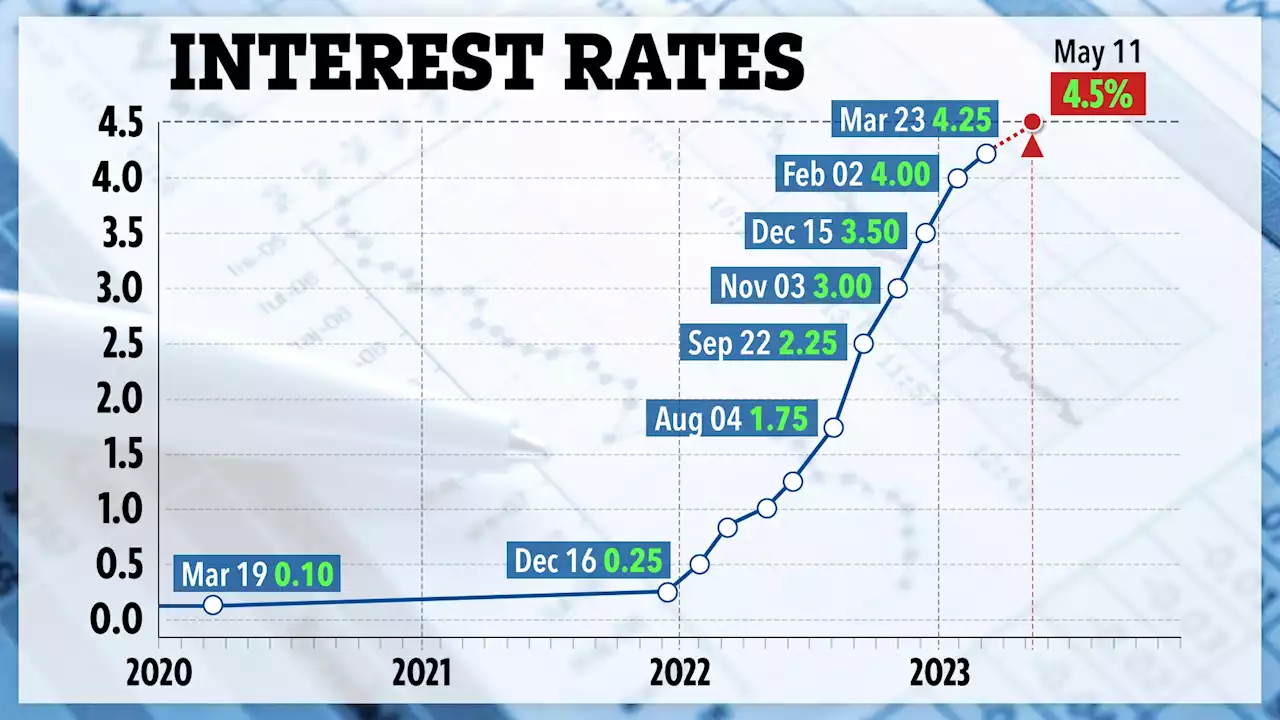

Some mortgages set to rise ‘by £600 a year’ after Bank of England hikes interest rates to 4.5 per cent

The latest increase in interest rates is set to make life even more difficult for people on variable mortgages and some people with credit cards and overdrafts.

Announcing the decision to hike rates again, the Bank's MPC said there had been "repeated surprises about the resilience of demand" and that inflation had been stronger than expected as the price of food and other goods were higher amid the war in Ukraine.Picture:The two members of the MPC who wanted to keep rates unchanged said that inflation was already expected to fall considerably this year without the need to rise the rate again.

They said: "The committee judges that growth over much of the forecast period will be materially stronger than in the February report. "But unless we tackle rising prices, the cost of living crisis will only carry on - which is why we need to be resolute in sticking to our plan to halve inflation by the end of the year."They now expect that gross domestic product will not fall during a single quarter this year, meaning the economy is not set to decline and the UK could avoid a recession.

United Kingdom Latest News, United Kingdom Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Mortgage warning for millions as Bank of England hikes interest rates AGAINMILLIONS of homeowners will face higher mortgage repayments after the Bank of England hiked interest rates again. The central bank’s base rate has increased from 4.25% to 4.5%. The rate is us…

Mortgage warning for millions as Bank of England hikes interest rates AGAINMILLIONS of homeowners will face higher mortgage repayments after the Bank of England hiked interest rates again. The central bank’s base rate has increased from 4.25% to 4.5%. The rate is us…

Read more »

Bank of England hikes interest rates to 4.5% - its highest level since 2008BREAKING: Britain’s interest rates have risen to 4.5%, the Bank of England's highest level since 2008.

Bank of England hikes interest rates to 4.5% - its highest level since 2008BREAKING: Britain’s interest rates have risen to 4.5%, the Bank of England's highest level since 2008.

Read more »

‘We will not change Bank of England’s inflation target’ Treasury ministers vowFinancial watchdogs facing benchmarks to keep City competitive amid claims of 'unaccountable' regulators

‘We will not change Bank of England’s inflation target’ Treasury ministers vowFinancial watchdogs facing benchmarks to keep City competitive amid claims of 'unaccountable' regulators

Read more »

What the Bank of England's interest rate announcement this week means for youEconomists are concerned that the Base Rate could rise to the same levels it was at during the 2008 financial crisis

What the Bank of England's interest rate announcement this week means for youEconomists are concerned that the Base Rate could rise to the same levels it was at during the 2008 financial crisis

Read more »

Bank of England to impose another interest rate hike as UK inflation proves stubbornFinancial markets and economists have priced in another rate rise today and their focus will be on the Bank's updated forecasts for signs that a pause lies ahead.

Bank of England to impose another interest rate hike as UK inflation proves stubbornFinancial markets and economists have priced in another rate rise today and their focus will be on the Bank's updated forecasts for signs that a pause lies ahead.

Read more »

House prices were going to fall anyway - the Bank of England is just helping them alongThe Bank of England is making it clear that the era of cheap credit is well and truly over While it’s unlikely that there will be a housing market crash like the one seen after the 2008 global financial crisis, a downturn is likely 🏠 Victoria_Spratt

House prices were going to fall anyway - the Bank of England is just helping them alongThe Bank of England is making it clear that the era of cheap credit is well and truly over While it’s unlikely that there will be a housing market crash like the one seen after the 2008 global financial crisis, a downturn is likely 🏠 Victoria_Spratt

Read more »