Major banks and building societies are preparing to slash interest rates on hundreds of savings accounts starting in March and April. Savers are urged to compare rates and switch accounts to secure better returns before these cuts take effect.

Savers face a spring massacre as major banks and building societies slash interest rates on more than one hundred accounts, shrinking returns for millions ahead of the new financial year. If you currently have money saved in any of these accounts, you might want to consider moving your cash to get a better deal. has analyzed banking data to uncover that returns on more than 180 accounts are scheduled to be slashed in March and April. Rachel Springall, finance expert at Moneyfacts compare.co.

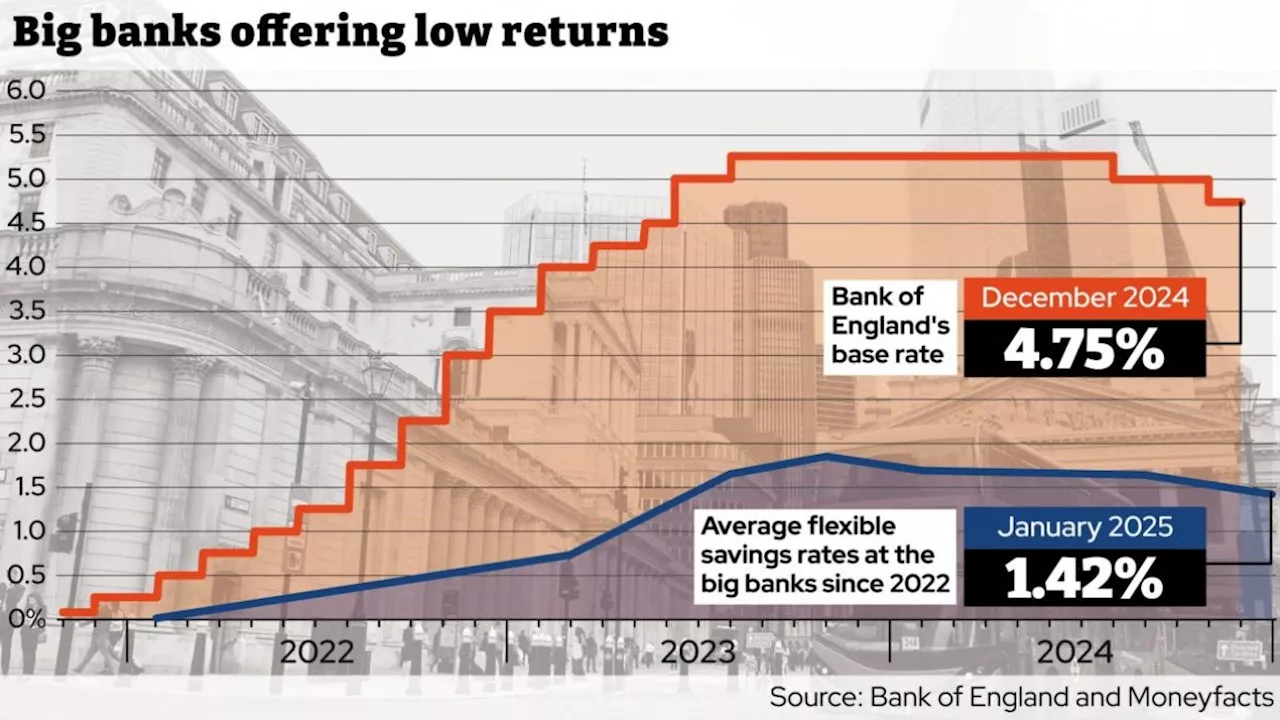

uk, said: 'It's so disheartening to see savings rates chopped in the last few days, but it just proves why savers are at the mercy of base rate cuts. 'Not even challenger banks have been able to escape making cuts as the market sentiment for lower interest rates has taken charge.'For instance, with some types of accounts, the interest rate you get on your savings is locked in for a set period of time. Similarly, the average one-year fixed bond rate has decreased from 4.08% to 3.94% over the same period. 'Now is an ideal time for savers to consider grabbing a fixed rate deal so they can get a guaranteed return on their cash. To help you stay informed, we've compiled a list of major banks and building societies currently reducing their savings rates, along with tips on comparing rates at any time. If you are sitting in one of the accounts listed below, it might be time to consider switching for a better deal. HSBC is set to reduce the interest rates on its easy-access Premier Savings account twice in the coming months - first in February and then again in April. From February 24, the rate for balances below £50,000 will drop from 1.98% to 1.74%, before decreasing further to 1.49% on April 17. On the same day, the rate for the bank's Online Bonus Saver - available to customers who refrain from making withdrawals during the month - will also decrease from 1.74% to 1.49%. Loyalty Cash ISA rates for all other customers will fall from 2.5% to 2.35%. Rates offered on HSBC's Help to Buy ISA will also fall from 3.2% to 2.96% for balances up to £12,000 and from 1.49% to 1.34% for balances over this amount. FEWER big money Premium Bonds prizes will be available from the April draw, as the prize fund rate is slashed from 4.00% to 3.80%. The changes mean that, for example, the estimated number of £100,000 prizes will decrease from 82 in February to an estimated 78 in April. The number of £50,000 prizes will fall from 164 in February to an estimated 157 in April, while the number of £25,000 prizes will reduce from 328 to around 313 over the same period. The number of £1 million prizes up for grabs will remain the same, at two. There will be more chances to win a £25 prize, with the number increasing from 1,807,915 in February to an estimated 2,170,903 in April. The total value of the prize pot will reduce from £430,052,425 in February to an estimated £411,118,825 in April. The number of prizes will remain around level, at 5,864,354 in February and an estimated 5,901,229 in April. Direct Saver will fall to 3.30% AER from 3.50% and the rate on Income Bonds will decrease to 3.30% AER from 3.49%. For instance, individuals holding a standard easy-access online E-Saver account will see savings rates drop from 2.15% to 2% as of March 19. Customers with an Albion Access Account or Treasurers Saver Account will then see their savings rates fall on May 7. Leek Building Society is slashing the savings rates offered on 36 variable rate savings accounts on March 3. Individuals holding a standard Easy Access Saver account will see a reduction in their savings rate from 2.45% to 2.2% next month. NatWest The rate offered on its Digital Regular Saver will fall from 1.50% to 1.25% for balances above £5,000. The rate offered on its easy access Flexible Saver will also fall from 1.50% to 1.25% on balances up to £25,000. Skipton Building Society is slashing the savings rates offered on 94 variable rate savings accounts on March 6. For example, those with a standard easy-access Branch eSaver will see their savings rate cut from 2.95% to 2.8%. Customers savings into the building society's 90 Day Notice Account will also see their savings rate cut from 3.25% to 3%. Check to see if the savings rate on your Skipton Building Society account will fall using our tool below. WITH your current savings rates in mind, don't waste time looking at individual banking sites to compare rates - it'll take you an eternity. These will help you save you time and show you the best rates available. As a benchmark, you'll want to consider any account that currently pays more interest than the current level of inflation - 2%. It's always wise to have some money stashed inside an easy-access savings account to ensure you have quick access to cash to deal with any emergencies like a boiler repair, for example

SAVINGS RATES BANKING MONEYFACTS PREMIUM BONDS INFLATION FINANCIAL YEAR

United Kingdom Latest News, United Kingdom Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Nine major disability benefit changes that could come this springThe Department for Work and Pensions (DWP) is set to announce nine major changes to disability benefits this spring as the government bids to reduce the rising costs

Nine major disability benefit changes that could come this springThe Department for Work and Pensions (DWP) is set to announce nine major changes to disability benefits this spring as the government bids to reduce the rising costs

Read more »

Major Bird Flu outbreak sees major cull of laying hens at farm near WemA devastating outbreak of highly pathogenic avian influenza (HPAI or H5N1) has struck a major egg production site near Wem, leading to the reported culling of over a million laying hens.

Major Bird Flu outbreak sees major cull of laying hens at farm near WemA devastating outbreak of highly pathogenic avian influenza (HPAI or H5N1) has struck a major egg production site near Wem, leading to the reported culling of over a million laying hens.

Read more »

Santander and Yorkshire Building Society Cut Rates After Bank of England ReductionSantander becomes one of the first UK high street banks to lower rates on savings accounts and mortgages following the Bank of England's decision to cut rates from 4.75% to 4.5%. The bank announced changes to some of its mortgage products and savings accounts, while Yorkshire Building Society also reduced rates on most of its savings products. Fixed-rate mortgage deals and fixed-rate savings accounts remain unaffected.

Santander and Yorkshire Building Society Cut Rates After Bank of England ReductionSantander becomes one of the first UK high street banks to lower rates on savings accounts and mortgages following the Bank of England's decision to cut rates from 4.75% to 4.5%. The bank announced changes to some of its mortgage products and savings accounts, while Yorkshire Building Society also reduced rates on most of its savings products. Fixed-rate mortgage deals and fixed-rate savings accounts remain unaffected.

Read more »

Unexpected Tax Bills Loom for UK Savers with £3,500+ HoldingsPeople with savings exceeding £3,500 are warned about potential tax liabilities due to rising interest rates. The HMRC can automatically detect interest earned, and if it surpasses the Personal Savings Allowance threshold, additional tax will be owed. Basic-rate taxpayers can earn up to £1,000 in savings interest tax-free annually, but this allowance reduces to £500 for higher earners. With current interest rates, even modest savings could push individuals over the limit, leading to unexpected tax bills.

Unexpected Tax Bills Loom for UK Savers with £3,500+ HoldingsPeople with savings exceeding £3,500 are warned about potential tax liabilities due to rising interest rates. The HMRC can automatically detect interest earned, and if it surpasses the Personal Savings Allowance threshold, additional tax will be owed. Basic-rate taxpayers can earn up to £1,000 in savings interest tax-free annually, but this allowance reduces to £500 for higher earners. With current interest rates, even modest savings could push individuals over the limit, leading to unexpected tax bills.

Read more »

Simple Savings Challenge Could Net You Nearly £700 by the End of the YearA straightforward savings challenge called the '1p savings challenge' allows individuals to build a substantial savings pot by the end of 2025, potentially reaching nearly £700. Even if you join later, significant savings are achievable.

Simple Savings Challenge Could Net You Nearly £700 by the End of the YearA straightforward savings challenge called the '1p savings challenge' allows individuals to build a substantial savings pot by the end of 2025, potentially reaching nearly £700. Even if you join later, significant savings are achievable.

Read more »

UK's Biggest Banks Cut Savings Rates Despite Bumper ProfitsMajor UK banks like Barclays, HSBC, Lloyds, NatWest, and Santander are offering significantly lower interest rates on easy-access savings accounts compared to the market average. This comes despite these banks reporting substantial profits in recent years.

UK's Biggest Banks Cut Savings Rates Despite Bumper ProfitsMajor UK banks like Barclays, HSBC, Lloyds, NatWest, and Santander are offering significantly lower interest rates on easy-access savings accounts compared to the market average. This comes despite these banks reporting substantial profits in recent years.

Read more »