This article offers financial advice on how to handle a sudden influx of money, such as an inheritance or lottery winnings. It emphasizes prioritizing debt repayment, building an emergency fund, and planning for long-term goals like retirement or homeownership. The article also explores different savings options, including ISAs and stocks and shares, and highlights the importance of investing for long-term growth.

If getting an inheritance or sudden windfall of cash, it can be difficult to know where to put it. Experts tellIf a lump sum of money – perhaps £30,000 – landed in your bank account tomorrow, what would you do with it?What you decide to do with a windfall will depend on your current financial situation.that are attracting heavy interest payments should prioritise paying those off, while perhaps keeping a small sum for any unexpected expenses to prevent them falling even deeper into the red.

Haine suggests keeping aside a bigger proportion of your regular expenses – closer to six to 12 months’ worth of outgoings.Is there anything you’re saving for in particular, such as buying a house, having a child or retirement? And how soon do you want access to your money? Remember not to stash too much in a regular bank or building society savings account as this could mean you breach yourBasic-rate taxpayers will reach their PSA with £1,000 in interest, while those paying the higher 40 per cent tax rate will see their allowance drop to £500.

It’s worth noting, however, that there is a withdrawal charge if you take the money out for anything other than buying a house or retirement.

FINANCIAL ADVICE WINDFALL SAVINGS INVESTING DEBT EMERGENCY FUND RETIREMENT

United Kingdom Latest News, United Kingdom Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

TSB and Halifax Clarify Important Savings Limits Rules for CustomersTSB Bank and Halifax have recently provided clarity on crucial savings limits rules for their customers, responding to queries about making payments and managing Individual Savings Accounts (ISAs). TSB addressed limits on external transfers from savings accounts and outlined the daily transfer limits for current accounts. Halifax explained the rules surrounding reactivating existing ISAs after opening new ones with other providers within the same tax year.

TSB and Halifax Clarify Important Savings Limits Rules for CustomersTSB Bank and Halifax have recently provided clarity on crucial savings limits rules for their customers, responding to queries about making payments and managing Individual Savings Accounts (ISAs). TSB addressed limits on external transfers from savings accounts and outlined the daily transfer limits for current accounts. Halifax explained the rules surrounding reactivating existing ISAs after opening new ones with other providers within the same tax year.

Read more »

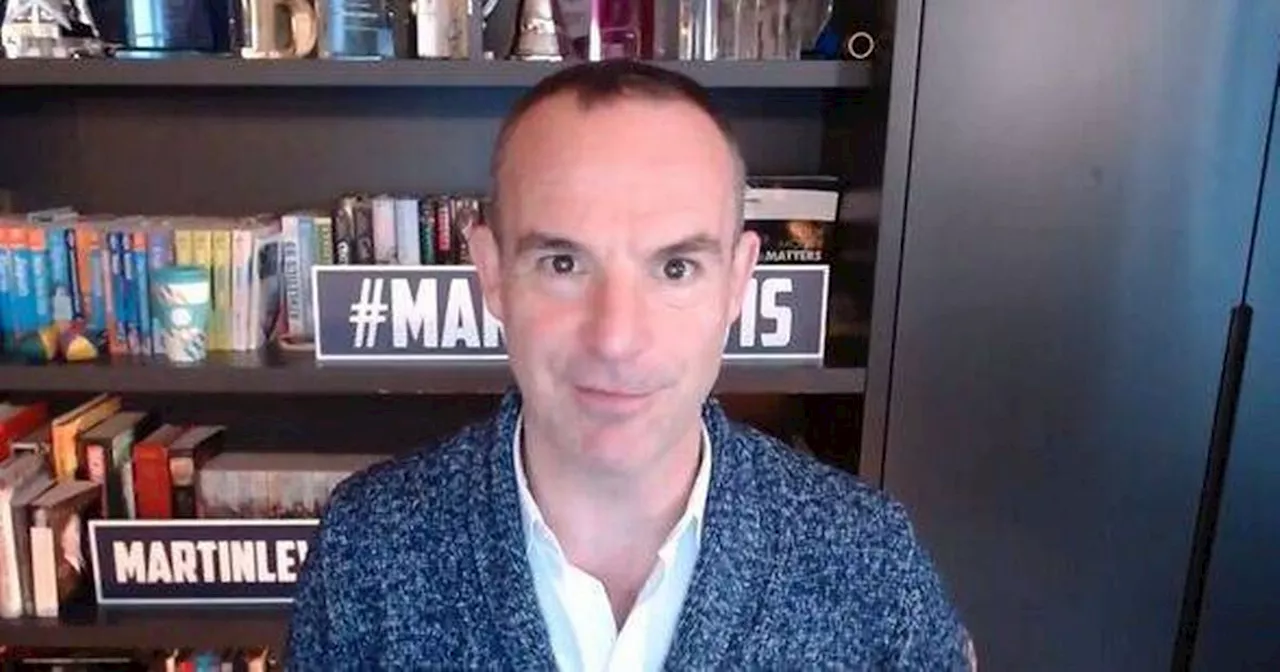

Martin Lewis Reveals Two Legal Methods to Avoid Paying Tax on SavingsFinancial expert Martin Lewis shares two legal strategies to minimize taxes on savings, including utilizing cash ISAs and Premium Bonds.

Martin Lewis Reveals Two Legal Methods to Avoid Paying Tax on SavingsFinancial expert Martin Lewis shares two legal strategies to minimize taxes on savings, including utilizing cash ISAs and Premium Bonds.

Read more »

Thousands of Savers Could Be Owed Cash After Big Pension FailureNationwide Building Society will be lowering interest rates on a number of its savings accounts from February 1st. This comes after a recent rate cut, and while some popular accounts will be unaffected, others will see reductions of up to 0.26%. The changes primarily affect easy-access accounts and ISAs, though some regular savers may also be impacted.

Thousands of Savers Could Be Owed Cash After Big Pension FailureNationwide Building Society will be lowering interest rates on a number of its savings accounts from February 1st. This comes after a recent rate cut, and while some popular accounts will be unaffected, others will see reductions of up to 0.26%. The changes primarily affect easy-access accounts and ISAs, though some regular savers may also be impacted.

Read more »

800,000 More Brits Face Tax Bills on Savings as Allowance Freeze PersistsPersonal savings allowance freezes are leading to an increased number of Britons facing higher or new income tax bills due to interest earned on their savings. Experts warn that millions could be caught off guard, prompting a potential surge in the popularity of tax-free ISAs.

800,000 More Brits Face Tax Bills on Savings as Allowance Freeze PersistsPersonal savings allowance freezes are leading to an increased number of Britons facing higher or new income tax bills due to interest earned on their savings. Experts warn that millions could be caught off guard, prompting a potential surge in the popularity of tax-free ISAs.

Read more »

Martin Lewis Reveals Tax-Saving Strategies for UK SaversMoney Saving Expert founder Martin Lewis shares practical tips on how to avoid paying taxes on savings exceeding £10,000. He highlights the benefits of Cash ISAs and Premium Bonds, emphasizing the importance of understanding personal savings allowances based on income level.

Martin Lewis Reveals Tax-Saving Strategies for UK SaversMoney Saving Expert founder Martin Lewis shares practical tips on how to avoid paying taxes on savings exceeding £10,000. He highlights the benefits of Cash ISAs and Premium Bonds, emphasizing the importance of understanding personal savings allowances based on income level.

Read more »

Martin Lewis Shares Tax-Saving Tip for Substantial SaversFinancial guru Martin Lewis advises individuals with savings exceeding £10,000 on how to avoid paying tax on their interest earnings. He highlights the benefits of utilizing Cash ISAs and understanding personal savings allowances.

Martin Lewis Shares Tax-Saving Tip for Substantial SaversFinancial guru Martin Lewis advises individuals with savings exceeding £10,000 on how to avoid paying tax on their interest earnings. He highlights the benefits of utilizing Cash ISAs and understanding personal savings allowances.

Read more »