House prices have surged by 2,534% in 50 years, while salary growth has failed to keep up, data shows.

House prices have surged by 2,534% - and salaries have not kept up, data showsAn analysis of house prices, salaries and deposits every year since 1974 reveals how tough it can be for couples today to buy their first home.

However, according to Mojo's analysis, today's salaries are £13,676 short of keeping pace with house prices. The average deposit as a percentage of two people's income in 1974 was 15.05 per cent, compared to 86.65 per cent this year. RELATED ARTICLES Share this article Share House prices and salariesThe data suggests that if salaries had grown at the same rate as the average house price, today's average salary would be £47,320, which is markedly higher than £33,644.

Many are still finding ways to make their home ownership dreams a reality, even amid rising costs Fast-forward to 2004 and and average property prices jumped to £147,462. However, a couple's joint salaries increased to £43,711. This prompted the house price to income ratio to spike to 3.4 times, making it tougher to get on the property ladder.

John Fraser-Tucker, head of mortgages at Mojo Mortgages, told This is Money: 'Our analysis has made it clear that today’s first-time buyers are navigating a much tougher landscape than those who entered the market in 1974.' Be aware that having a bigger deposit as a proportion of the purchase price will mean you own more of your home outright and have less to pay back overall. In theory, the bigger your deposit is, the lower your mortgage rate should be, though this may not apply for all borrowers as factors such as income and credit rating are also taken into account.

Stamp duty, survey costs, legal fees, removal and potential renovation costs all need to be factored in. 'I’d also recommend setting a clear savings goal. Instead of simply saving what you can, create a structured plan that outlines how much you need to save each month to reach your deposit target within a reasonable timeframe. Automating your savings can simplify this process.

Most mortgage deals allow fees to be added to the loan and only be charged when it is taken out. This means borrowers can secure a rate without paying expensive arrangement fees.

United Kingdom Latest News, United Kingdom Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Budget 2024: Budget 2024: Rachel Reeves hands Scottish Government extra £3.4bnThe Labour Chancellor has announced the 'largest real-terms funding settlement' for devolved governments in 25 years.

Budget 2024: Budget 2024: Rachel Reeves hands Scottish Government extra £3.4bnThe Labour Chancellor has announced the 'largest real-terms funding settlement' for devolved governments in 25 years.

Read more »

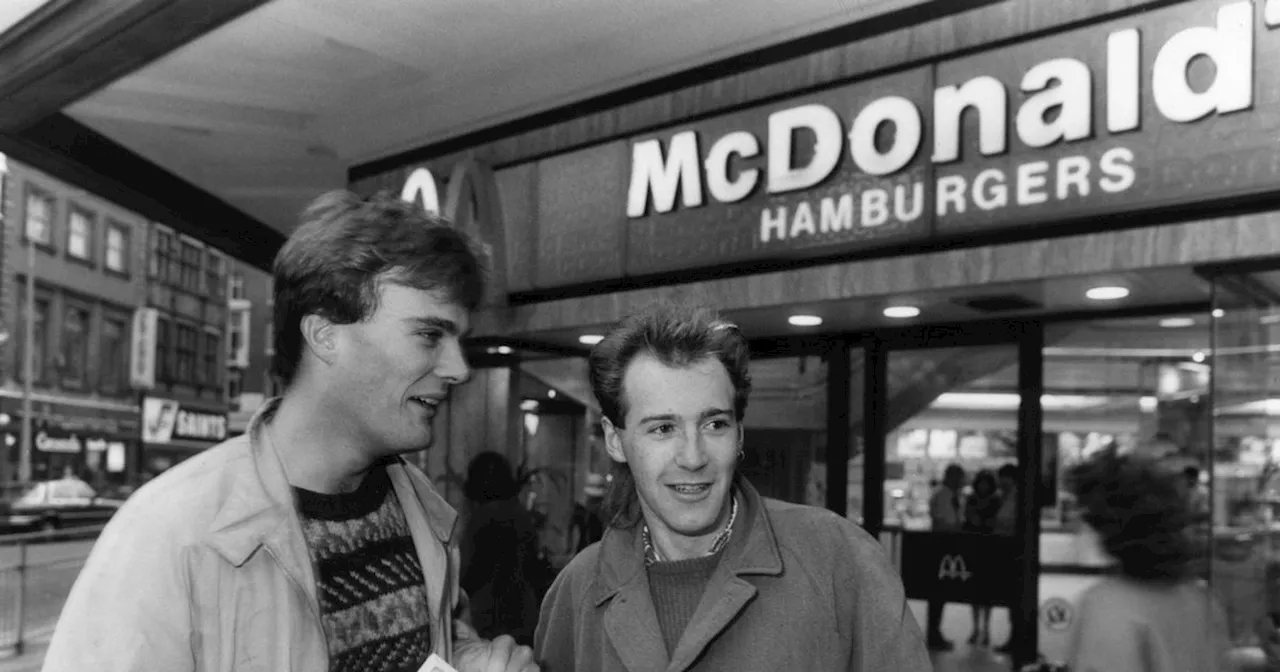

39 years of McDonald's in Liverpool as brand hits milestone in UKThe first McDonald's opened in the UK in 1974

39 years of McDonald's in Liverpool as brand hits milestone in UKThe first McDonald's opened in the UK in 1974

Read more »

'The Birmingham pub bombings affected my whole life'A survivor and a former police officer share their memories of the bombing attacks in 1974.

'The Birmingham pub bombings affected my whole life'A survivor and a former police officer share their memories of the bombing attacks in 1974.

Read more »

2024 first aid guidelines offer expanded recommendations for emergency careThe American Heart Association and the American Red Cross today released the '2024 Guidelines for First Aid,' which provide critical updates that equip first aid responders with the latest evidence-based practices to effectively respond to mild, moderate and life-threatening emergencies.

2024 first aid guidelines offer expanded recommendations for emergency careThe American Heart Association and the American Red Cross today released the '2024 Guidelines for First Aid,' which provide critical updates that equip first aid responders with the latest evidence-based practices to effectively respond to mild, moderate and life-threatening emergencies.

Read more »

First day of Manchester Christmas Markets 2024 in picturesThe Manchester Christmas Markets have returned for 2024

First day of Manchester Christmas Markets 2024 in picturesThe Manchester Christmas Markets have returned for 2024

Read more »

Rodri's first words after Man City ace wins Ballon d'Or 2024Manchester City midfielder Rodri has made history after winning the Ballon d'Or for the very first time amid Real Madrid controversy

Rodri's first words after Man City ace wins Ballon d'Or 2024Manchester City midfielder Rodri has made history after winning the Ballon d'Or for the very first time amid Real Madrid controversy

Read more »