Finance experts advise that those working from home and self-employed individuals may be eligible to claim a portion of their heating and household bills against their tax bill. You can potentially reduce your tax burden if you're a sole trader operating from home and list heating as a business expense. Similarly, those required to work from home, even partially, might qualify for tax relief on additional household costs. However, strict eligibility criteria apply, with HMRC providing detailed information. Tax relief is available for work-related expenses and specific situations where working from home is mandated, not chosen. The amount claimable depends on factors like hours worked from home and the proportion of shared expenses used for business purposes.

Finance experts are advising those working from home and the self-employed that they might be able to claim a portion of their heating and household bills against their tax bill. If you're a sole trader operating from home, you can list your heating as a running cost for your business, potentially reducing your tax bills.

Tax relief can be claimed if you're required to work from home due to job requirements or lack of an office from your employer. However, you cannot claim tax relief if you choose to work from home, including situations where your employment contract allows remote work or when your employer's office is full.

The tax regulations specify that workers cannot claim for items used for both personal and business purposes, such as rent or broadband access. As for the amount you can claim, you have two options: either £6 a week or the precise amount you've spent. “For example, say there are five rooms in the home and one is used as a full-time office, studio or place of work, with a yearly electricity bill of £1,000. Dividing that by five means it would be possible to claim £200 as an allowable expense. "

Business Taxes TAX RELIEF WORK FROM HOME SELF-EMPLOYED HOUSEHOLD EXPENSES HMRC

United Kingdom Latest News, United Kingdom Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

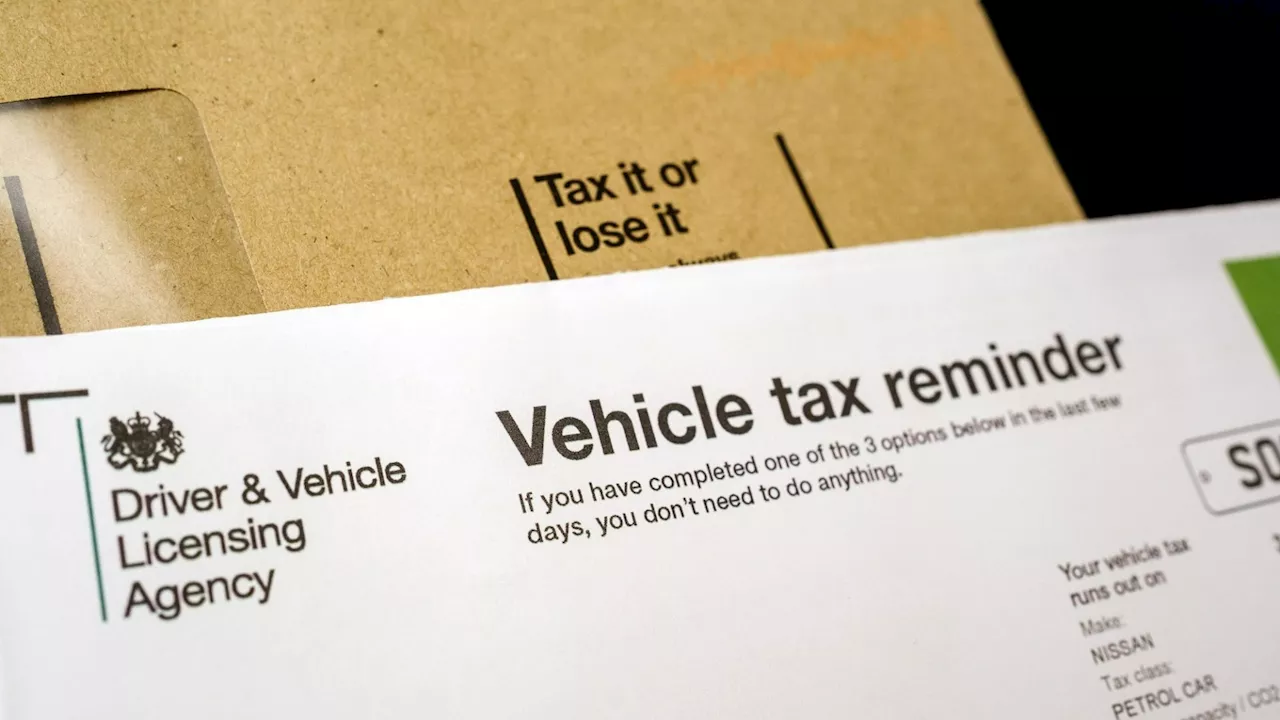

Car Tax Changes 2025: Electric Vehicles Face Tax for the First TimeSeven changes to car tax and Vehicle Excise Duty (VED) are coming in 2025, impacting both petrol/diesel and electric vehicle owners. Electric vehicles will no longer be exempt from VED, with a low first-year rate applying to new zero-emission cars. All other cars will face higher VED rates.

Car Tax Changes 2025: Electric Vehicles Face Tax for the First TimeSeven changes to car tax and Vehicle Excise Duty (VED) are coming in 2025, impacting both petrol/diesel and electric vehicle owners. Electric vehicles will no longer be exempt from VED, with a low first-year rate applying to new zero-emission cars. All other cars will face higher VED rates.

Read more »

I tested a hangover supplement for my work Christmas partyI tried the Myrkl hangover supplement for my work Christmas party, but does it work?

I tested a hangover supplement for my work Christmas partyI tried the Myrkl hangover supplement for my work Christmas party, but does it work?

Read more »

Pakistan U-Turns on Bank Tax, Citing Lender BacklashPakistan has reversed its plan to impose a new tax on banks' profits from government debt, opting instead for a higher overall income tax. The original plan aimed to encourage lending to the private sector by requiring banks to increase their advances-to-deposit ratio (ADR) to over 50% or face a penalty tax. Banks resisted the measure, leading to legal challenges and deposit fee increases. The government will now raise the income tax on banks to 44% and gradually decrease it over the next few years.

Pakistan U-Turns on Bank Tax, Citing Lender BacklashPakistan has reversed its plan to impose a new tax on banks' profits from government debt, opting instead for a higher overall income tax. The original plan aimed to encourage lending to the private sector by requiring banks to increase their advances-to-deposit ratio (ADR) to over 50% or face a penalty tax. Banks resisted the measure, leading to legal challenges and deposit fee increases. The government will now raise the income tax on banks to 44% and gradually decrease it over the next few years.

Read more »

Car Tax Set for Increase in 2024, Electric Vehicle Owners Will See SavingsThe UK government is introducing changes to vehicle excise duty (VED), commonly known as car tax, in 2024. While many car models will see increases in their annual tax liability, electric vehicle (EV) owners will continue to benefit from a low tax rate of £10 until 2029-30. However, premium electric vehicles priced at £40,000 or more will be subject to an additional supplementary tax.

Car Tax Set for Increase in 2024, Electric Vehicle Owners Will See SavingsThe UK government is introducing changes to vehicle excise duty (VED), commonly known as car tax, in 2024. While many car models will see increases in their annual tax liability, electric vehicle (EV) owners will continue to benefit from a low tax rate of £10 until 2029-30. However, premium electric vehicles priced at £40,000 or more will be subject to an additional supplementary tax.

Read more »

HMRC Advises on Tax Implications of Selling Unwanted Christmas Gifts OnlineThe UK's tax authority, HMRC, has issued guidance regarding the tax implications of selling unwanted Christmas gifts online. Personal items sold occasionally, such as clothing, electronics, and furniture, are not subject to income tax. However, capital gains tax may apply to high-value items (over £6,000) or sets of items. HMRC emphasizes that individuals should assess if they need to declare their income, even if it's not taxable.

HMRC Advises on Tax Implications of Selling Unwanted Christmas Gifts OnlineThe UK's tax authority, HMRC, has issued guidance regarding the tax implications of selling unwanted Christmas gifts online. Personal items sold occasionally, such as clothing, electronics, and furniture, are not subject to income tax. However, capital gains tax may apply to high-value items (over £6,000) or sets of items. HMRC emphasizes that individuals should assess if they need to declare their income, even if it's not taxable.

Read more »

Divorce Month? Tax Planning Makes Marriage More AppealingThe article explores the impact of recent tax changes on divorce and marriage in the UK. It examines a couple's unconventional plan to divorce for financial benefits, highlighting the complexities of inheritance tax and pensions in modern relationships. The article concludes by suggesting that marriage offers more tax advantages than divorce, particularly with proposals to make it easier for spouses to transfer assets tax-free.

Divorce Month? Tax Planning Makes Marriage More AppealingThe article explores the impact of recent tax changes on divorce and marriage in the UK. It examines a couple's unconventional plan to divorce for financial benefits, highlighting the complexities of inheritance tax and pensions in modern relationships. The article concludes by suggesting that marriage offers more tax advantages than divorce, particularly with proposals to make it easier for spouses to transfer assets tax-free.

Read more »