More than 1.6 million pensioners will be forced into paying income tax over the next four years, as a result of a Government stealth tax raid. The state pension rise will push up to 600,000 people over their personal allowance threshold, while the freeze on tax allowances will affect an additional 1.2 million pensioners. By 2028, it is estimated that 9.3 million people over the age of 66 will be paying income tax.

More than 1.6 million pensioners will be forced into paying income tax over the next four years, as a result of a Government stealth tax raid. An official analysis of the Prime Minister and Chancellor Jeremy Hunt's tax plans has revealed that up to 600,000 people will be dragged over their personal allowance threshold – the point at which you must start paying tax – when the state pension rises next Monday. Around 1.

2 million extra pensioners will have to pay income in the new tax year as a result of the Government's freeze on tax allowances, according to research from the House of Commons Library, commissioned by the Liberal Democrats. As many as 9.3 million people over age 66 will be paying the tax by 2028, it found. The personal allowance typically rises by inflation but has been frozen since 2021 at £12,570 and will remain at that level until 2028. The new state pension will rise by £902.20 a year from April 8, under the Government's 'triple lock' pledg

Pensioners Income Tax Tax Plans Personal Allowance State Pension Tax Allowances Freeze Inflation Triple Lock

United Kingdom Latest News, United Kingdom Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Council Tax changes from next week including higher bills and double tax ruleCouncil tax bills are set to rise significantly in a matter of days

Council Tax changes from next week including higher bills and double tax ruleCouncil tax bills are set to rise significantly in a matter of days

Read more »

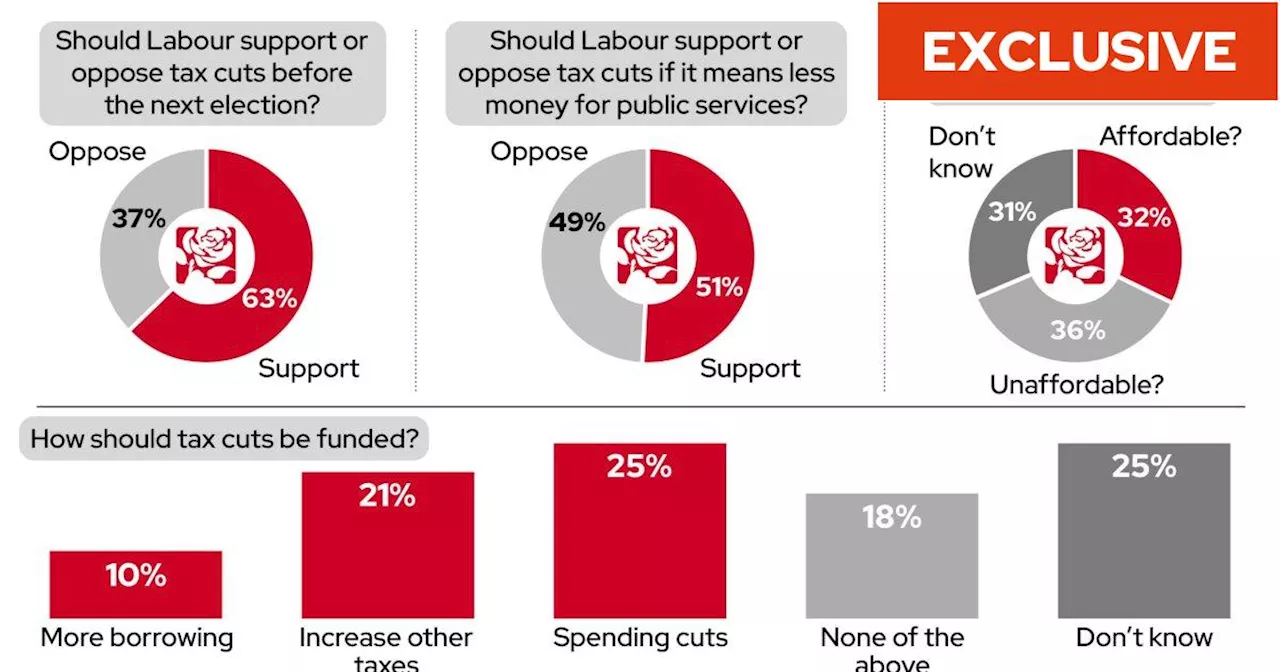

Starmer’s tax dilemma: Voters split on whether Labour should back more tax cutsLabour voters say party should oppose further tax cuts to free up cash for public services, but Tory target voters say the opposite

Starmer’s tax dilemma: Voters split on whether Labour should back more tax cutsLabour voters say party should oppose further tax cuts to free up cash for public services, but Tory target voters say the opposite

Read more »

Scrapping non-dom tax status 'an utter humiliation' for government, Labour claimsAsked why she was not praising the chancellor for taking an idea she supports, Rachel Reeves said: 'Imagine what good could have been done if the chancellor and prime minister had done this years ago... They've run out of ideas.'

Scrapping non-dom tax status 'an utter humiliation' for government, Labour claimsAsked why she was not praising the chancellor for taking an idea she supports, Rachel Reeves said: 'Imagine what good could have been done if the chancellor and prime minister had done this years ago... They've run out of ideas.'

Read more »

Singtel loses $260 million tax case in AustraliaPLUS: Chinese tops Steam’s language charts; HPE opens Saudi server factory; Indian government apps have flaws

Singtel loses $260 million tax case in AustraliaPLUS: Chinese tops Steam’s language charts; HPE opens Saudi server factory; Indian government apps have flaws

Read more »

Cash-strapped council writes off £2 million in unpaid tax debtThe money was ruled 'irrecoverable'

Cash-strapped council writes off £2 million in unpaid tax debtThe money was ruled 'irrecoverable'

Read more »

Consumers could get 'boiler tax' refund after government kicks policy to 2025The green policy was scrapped after it was dubbed the 'boiler tax'

Consumers could get 'boiler tax' refund after government kicks policy to 2025The green policy was scrapped after it was dubbed the 'boiler tax'

Read more »