The banking group said it is making £2 billion of lending available to first-time buyers borrowing more than 4.5 times their income.

The banking group said it is making £2 billion of lending available to first-time buyers borrowing more than 4.5 times their income.

To qualify, and subject to affordability, customers must apply for a first-time buyer mortgage with Lloyds Bank or its sister brand Halifax, have a total employed household income of £50,000 or more, have a deposit of at least 10% and not be using shared ownership or shared equity schemes. Andrew Asaam, homes director at Lloyds Banking Group, said: “Getting the keys to a first home is a big deal, but it’s tough right now.

United Kingdom Latest News, United Kingdom Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Lloyds, First Direct, and Barclays customers hit with new bank changesFrom new overdraft fees to changes to using your card abroad

Lloyds, First Direct, and Barclays customers hit with new bank changesFrom new overdraft fees to changes to using your card abroad

Read more »

Lloyds to give cash to some customers who have accounts with themThe high street bank is offering free money to customers who have a student account with them. Lloyds has explained its new student account also comes with a host of benefits

Lloyds to give cash to some customers who have accounts with themThe high street bank is offering free money to customers who have a student account with them. Lloyds has explained its new student account also comes with a host of benefits

Read more »

Lloyds Bank issues £177 warning to all customersThe bank is urging people to 'beware'

Lloyds Bank issues £177 warning to all customersThe bank is urging people to 'beware'

Read more »

Lloyds hires Amazon Web Services executive as its new AI chiefUK high street bank creates new role for Rohit Dhawan as part of digital push

Lloyds hires Amazon Web Services executive as its new AI chiefUK high street bank creates new role for Rohit Dhawan as part of digital push

Read more »

Higher Crude Prices Help Tullow Oil Boost First-Half ProfitTullow Oil reported a significant increase in profits for the first half of the year, driven by higher oil production and stronger oil prices.

Higher Crude Prices Help Tullow Oil Boost First-Half ProfitTullow Oil reported a significant increase in profits for the first half of the year, driven by higher oil production and stronger oil prices.

Read more »

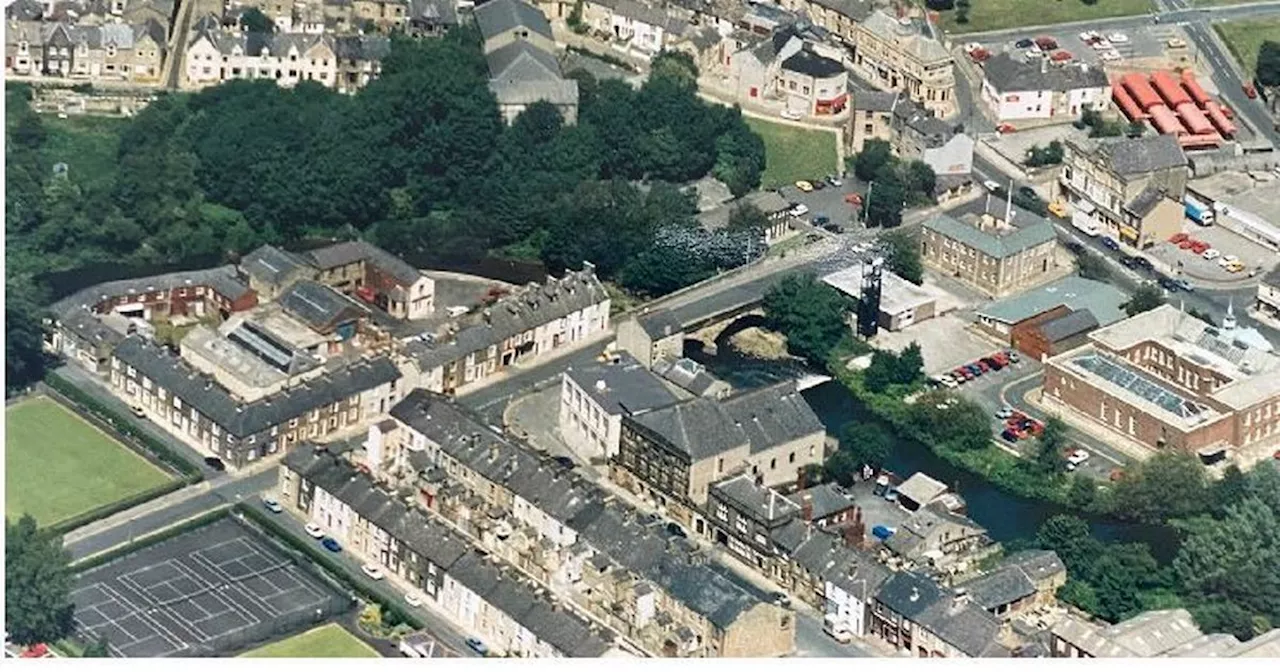

Lancs town to get landlord licensing for first time to boost housing standardsLandlords who fail to apply for a licence commit a criminal offence

Lancs town to get landlord licensing for first time to boost housing standardsLandlords who fail to apply for a licence commit a criminal offence

Read more »