Recent data reveals a significant rise in individuals opening and contributing to cash ISAs, exceeding previous records. This surge coincides with ongoing discussions about the future of cash ISAs, with some proposing potential changes to encourage investment in stocks and shares. Experts weigh the pros and cons of such alterations, highlighting the importance of cash ISAs for both short-term and long-term savers.

Providers have revealed a surge in individuals opening cash ISAs, while existing account holders are also actively increasing their deposits. Cash ISAs, a popular savings product, allow individuals to earn interest on their money without incurring tax, with a current annual limit of £20,000. Richard Dana, CEO of mortgage and savings platform Tembo, reported a significant increase in cash ISA applications, noting a 35% rise last week compared to the previous week.

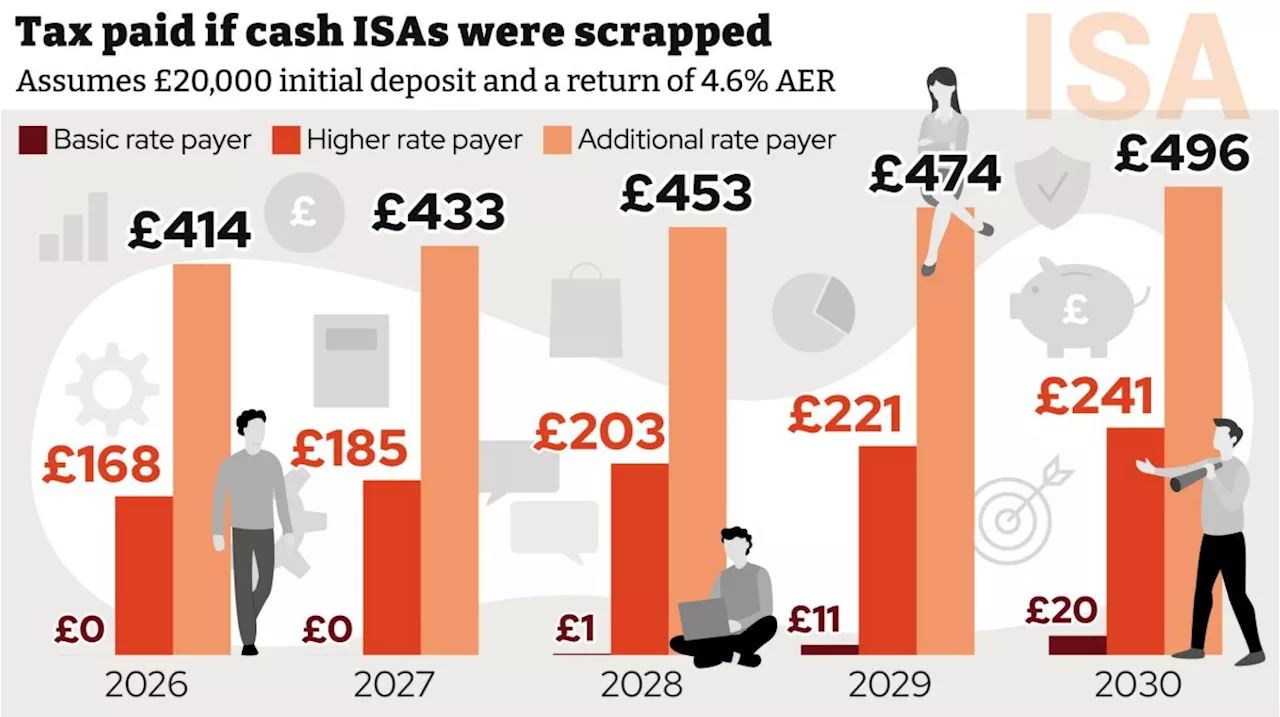

Moneybox, another provider of cash ISAs, observed a 14.7% surge in applications over the past 10 days compared to the previous period. Other providers have witnessed a notable uptick in deposits. Plum, known for offering competitive cash ISA rates, has seen a 13% rise in deposits since the beginning of the year. Meanwhile, Hargreaves Lansdown, a financial services company, reported a staggering 325% increase in cash ISA deposits on its savings platform year-to-date compared to the same period last year. They indicated that 56% of new clients visiting their site daily over the past week have opted to open a cash ISA, surpassing the number choosing traditional savings accounts. Mark Hicks, Head of Active Savings at Hargreaves Lansdown, attributed this shift in consumer behavior to recent discussions surrounding the future of cash ISAs. The debate, fueled by speculation, has highlighted the attractiveness of current cash ISA rates, which remain highly competitive. Hicks further suggested that acting before March could prove advantageous if cash ISA rates decline in the coming weeks, citing a 0.1% drop in fixed rates following the Bank of England's recent cut.Recent discussions have centered on the potential for enhancing returns on cash ISA investments by diverting funds towards stocks and shares, thereby supporting London's stock market. This proposal is purportedly aimed at stimulating economic growth through increased investment in UK companies. However, experts argue that abolishing cash ISAs would disproportionately penalize individuals with shorter-term savings needs, as investing is typically more suitable for those who can commit their funds for at least half a decade or longer, given the inherent fluctuations in returns over shorter periods. 2024 proved to be a record-breaking year for the cash ISA market, with savers depositing over £49.8 billion, surpassing the previous record of £47.1 billion in 2023, according to the Bank of England. Tom Riley, Nationwide's Director of Retail Products, emphasized the crucial role of cash ISAs in facilitating efficient savings for ordinary individuals, while also enabling the bank to fund first-time buyer mortgages. While Nationwide acknowledges that the cash ISA allowance should not be reduced, they advocate for making ISAs more user-friendly and tailored to the needs of savers. This could involve introducing an additional allowance to the existing £20,000 ISA limit specifically for investing in stocks and shares. Chris Irwin, Director of Savings at Yorkshire Building Society, expressed concerns that removing cash ISAs as an option for savers would have detrimental consequences for their financial well-being and potentially increase their tax liabilities

CASH ISAS SAVINGS BANKING INVESTMENT ECONOMIC GROWTH TAX MARKET SPECULATION

United Kingdom Latest News, United Kingdom Headlines

Similar News:You can also read news stories similar to this one that we have collected from other news sources.

Cash ISAs Under Threat: Should UK Savers Lose Tax-Free Savings?The future of Cash ISAs in the UK is uncertain as city firms push for their abolition, arguing that they encourage low returns and should be replaced by stocks and shares ISAs. Building societies strongly oppose this move, highlighting the crucial role Cash ISAs play for individuals saving for short-term goals and protecting them from higher taxes.

Cash ISAs Under Threat: Should UK Savers Lose Tax-Free Savings?The future of Cash ISAs in the UK is uncertain as city firms push for their abolition, arguing that they encourage low returns and should be replaced by stocks and shares ISAs. Building societies strongly oppose this move, highlighting the crucial role Cash ISAs play for individuals saving for short-term goals and protecting them from higher taxes.

Read more »

Cash ISAs: A Potential Target for Reform?Concerns have been raised about the future of Cash ISAs in the UK, with some financial institutions proposing their abolition. This move could lead to higher tax bills for millions of savers. The debate centers around the balance between encouraging long-term investment and providing a tax-efficient option for short-term savings.

Cash ISAs: A Potential Target for Reform?Concerns have been raised about the future of Cash ISAs in the UK, with some financial institutions proposing their abolition. This move could lead to higher tax bills for millions of savers. The debate centers around the balance between encouraging long-term investment and providing a tax-efficient option for short-term savings.

Read more »

Martin Lewis tells fan 'do the opposite' amid cash ISA raid fearsSpeculation is mounting that ISAs could be a target to raise revenue and finance guru wades in with his advice

Martin Lewis tells fan 'do the opposite' amid cash ISA raid fearsSpeculation is mounting that ISAs could be a target to raise revenue and finance guru wades in with his advice

Read more »

Government Considers Cash ISA Changes, Building Societies Push BackThe UK Government is reportedly considering changes to Cash ISAs, prompting calls from City firms to scrap the tax break. Building societies, however, strongly oppose this move, warning of potential negative consequences for savers. The article explores the different types of ISAs, their functionalities, and whether they remain the optimal choice for various financial situations.

Government Considers Cash ISA Changes, Building Societies Push BackThe UK Government is reportedly considering changes to Cash ISAs, prompting calls from City firms to scrap the tax break. Building societies, however, strongly oppose this move, warning of potential negative consequences for savers. The article explores the different types of ISAs, their functionalities, and whether they remain the optimal choice for various financial situations.

Read more »

Cash ISA Changes Spark Debate: Building Societies Fight for Saver BenefitsThe UK government is considering changes to cash ISAs, prompting a debate between City of London firms advocating for their elimination and building societies defending their importance for savers. The article analyzes the different types of ISAs, their tax benefits, and the considerations for choosing between a cash ISA and a traditional savings account.

Cash ISA Changes Spark Debate: Building Societies Fight for Saver BenefitsThe UK government is considering changes to cash ISAs, prompting a debate between City of London firms advocating for their elimination and building societies defending their importance for savers. The article analyzes the different types of ISAs, their tax benefits, and the considerations for choosing between a cash ISA and a traditional savings account.

Read more »

Cash Isa Tax Break Cuts Seen Triggering Mortgage CrisisThe UK Chancellor, Rachel Reeves, is facing warnings that reducing tax benefits on cash Isas could lead to a surge in mortgage rates and a housing market downturn. City firms argue that the nearly £300 billion held in cash Isas could generate better returns if invested in the stock market, but building societies warn that such a move would restrict lending and push up prices for homebuyers.

Cash Isa Tax Break Cuts Seen Triggering Mortgage CrisisThe UK Chancellor, Rachel Reeves, is facing warnings that reducing tax benefits on cash Isas could lead to a surge in mortgage rates and a housing market downturn. City firms argue that the nearly £300 billion held in cash Isas could generate better returns if invested in the stock market, but building societies warn that such a move would restrict lending and push up prices for homebuyers.

Read more »